Quick Summary :- This 2025 guide highlights the Top 10 Fintech Software Development Companies transforming the future of digital finance. From intelligent banking apps to secure blockchain solutions, these firms empower startups, financial institutions, and global enterprises with scalable, regulation-compliant software designed for agility, innovation, and long-term growth.

Ever wondered how fintech is reshaping the world of finance? From digital banking to blockchain, financial technology is revolutionizing transactions globally!

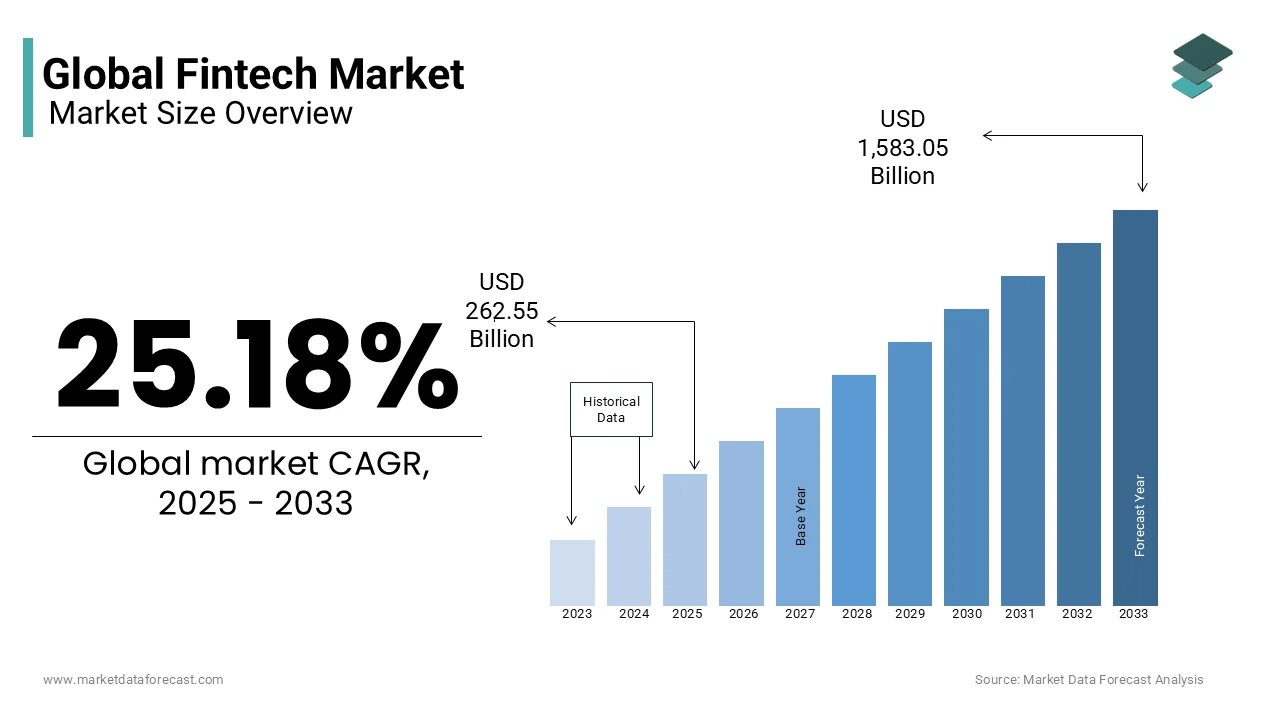

The Global Fintech Market is projected to reach $1583.05 billion by 2033 driven by innovations in AI, digital wallets, mobile banking and secure payment platforms. Companies are investing in software solutions that are scalable, compliant and cutting-edge.

Choosing the right Fintech Software Development Partner is critical. Trusted developers help businesses create secure, regulation-compliant platforms that streamline operations, enhance customer experiences and drive growth across global financial services.

Why Fintech Software Development Matters?

Fintech software development drives the transformation of global financial services. From mobile banking apps to AI-powered platforms, innovative software enables businesses to provide faster, secure, and user-friendly financial solutions.

Global payment and finance giants like PayPal, Block (formerly Square), Mastercard, Envestnet, and Upstart rely heavily on fintech software development to power seamless transactions, automate lending, and deliver personalized digital experiences at scale.

With increased digital adoption, regulatory compliance, and evolving customer expectations, robust fintech platforms are crucial for scalability, efficiency, and trust. Companies leveraging advanced development gain a competitive edge in an increasingly digital finance ecosystem.

How We Selected the Top Fintech Software Development Companies?

To ensure accuracy and trust, we followed clear benchmarks while choosing the top fintech software development companies. Each factor reflects expertise, compliance and proven success in fintech software solutions.

Industry Experience

We prioritized companies with 5-10+ years in fintech IT, demonstrating proven knowledge in banking, payments, lending and digital finance platforms along with successful delivery of enterprise grade financial software projects.

Compliance & Security

Firms were evaluated on adherence to global financial regulations such as PCI DSS, GDPR and regional banking compliance standards; ensuring secure and trustworthy fintech applications.

Technical Expertise

Companies with expertise in Generative AI, Blockchain, Cloud Computing, mobile banking and digital wallets were preferred, focusing on innovation that enhances user experience, efficiency and financial transaction security.

Client Portfolio

We considered firms with diverse fintech clients, from startups to banks and global enterprises, showcasing scalable solutions, successful case studies and proven industry trust.

Recognition & Reviews

Independent reviews on Clutch, GoodFirms and Gartner, along with awards, certifications and client testimonials, were assessed to ensure consistent quality and market recognition in the fintech domain.

💡 Did You Know?

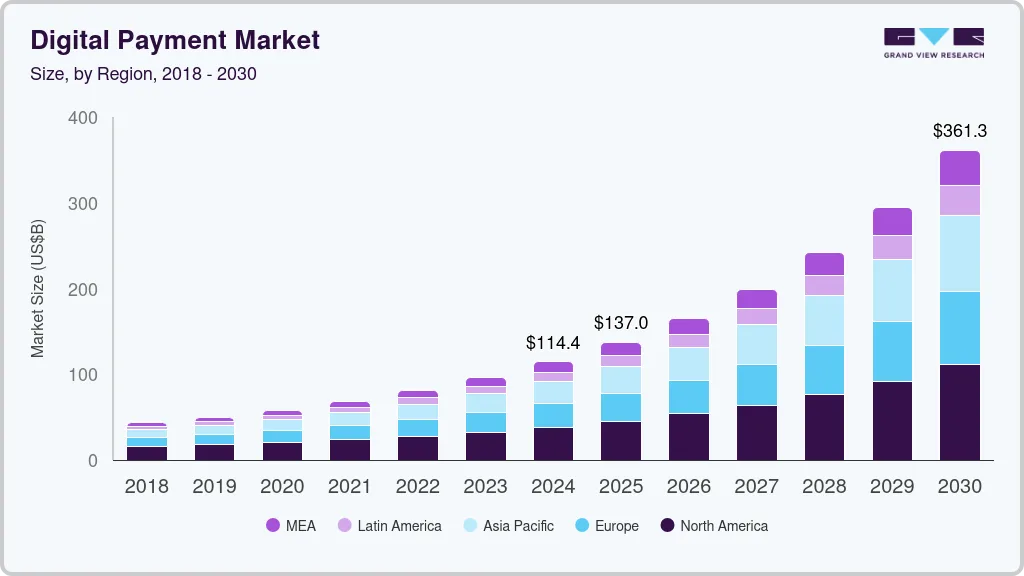

Digital payments are expected to reach $361.30 billion globally by 2030, driven by mobile wallets, contactless payments and fintech innovations worldwide.

Top Fintech Software Development Companies: Key Metrics at a Glance

This table provides a side by side comparison of the top 10 Fintech Software Development Companies, highlighting their location, hourly rates, Google ratings and areas of expertise.

| No. | Company | Location | Hourly Rate | Google Rating | Expertise |

| 1 | eSparkBiz | India | $12-$25/hr | ⭐ 4.2 |

|

| 2 | Fingent | White Plains, New York | $25-49/hr | ⭐ 4.4 |

|

| 3 | Armada Labs | Estero, Florida | $50-99/hr | N/A |

|

| 4 | SDK.finance | Vilnius, Lithuania | $30-50/hr | ⭐ 5.0 |

|

| 5 | Zymr | San Jose, California | $25-49/hr | ⭐ 4.5 |

|

| 6 | DigiPrima Technologies | Newport Beach, California | <$25/hr | ⭐ 5.0 |

|

| 7 | Zazz | Hyderabad, Telangana | $50-99/hr | ⭐ 4.6 |

|

| 8 | Newwave Solutions | Hanoi, Vietnam | <$25/hr | ⭐ 4.9 |

|

| 9 | Fulminous Software | Jaipur, Rajasthan | $25-49/hr | ⭐ 4.9 |

|

| 10 | Infograins | Indore, Madhya Pradesh | $50-99/hr | ⭐ 4.4 |

|

Detailed Profiles of Top Fintech Software Development Companies

Here’s an in depth look at each company’s strengths, expertise and Fintech software development capabilities to help you identify the right technology partner for your business.

1. eSparkBiz

eSparkBiz is a trusted Fintech Software Development Company with 15+ years of experience. They specialize in scalable web development and web apps offering tailored solutions for digital banking, payments, lending and regulatory compliance with advanced tech like Machine Learning, DevOps and Cloud Services.

Founded: 2010

Employees: 400+

Projects Completed: 1000+

Ratings: Clutch – 4.9 | Gartner – 5.0 | G2 – 5.0 | DesignRush – 4.5 | GoodFirms – 5.0

LinkedIn: esparkinfo

Website: esparkinfo.com

Notable Clients: OneForAllSocial, Radefy, Cision, ethos

Fintech Expertise:

- Digital banking platforms

- Payment gateways and wallets

- Lending and loan management solutions

- Trading & investment platforms

- Blockchain based payment apps

- Regulatory compliance (PCI DSS, GDPR, etc.)

Why Choose Them:

- ISO 9001:2015 and CMMI Level 3 certified with 95% client retention rate.

- Recognized for cost effective delivery, agile processes and global fintech expertise offering AI driven, secure and custom software solutions.

- Named #1 U.S. Software Development Company by IEEE Computer Society.

- One of the Top Custom Software Development as per Clutch Leader Matrix and Gartner

- HubSpot Certified Partner: Trusted for client focused development driving digital transformation.

- Clutch Ranked #1: Ranked among India’s Top Software Developers

- Dedicated support for long term software outsourcing performance

- eSparkBiz Honored by Clutch as a 2025 Top Cloud Consulting Leader in India

Client Testimonial:

We were satisfied with the website built by partnering with eSparkBiz. The team at eSparkBiz worked collaboratively with us, communicating frequently through Skype to provide timely updates and feedback on the areas for enhancement. We were also impressed with their strong communication skills, technical expertise, and timely delivery.

2. Fingent

Fingent is a leading fintech software development company, with 19+ years of experience. They specialize in custom digital banking solutions, mobile payment apps & AI driven financial platforms ensuring security, scalability & regulatory compliance.

Founded: 2003

Employees: 350+

Projects Completed: 800+

Ratings: Clutch – 4.9 | GoodFirms – 4.9 | DesignRush – 4.3

LinkedIn: fingent

Notable Clients: CBN, Raymond, Sony, Casenet

Fintech Expertise:

- Digital banking platforms

- Payment gateway integration

- AI powered lending solutions

- Mobile wallets and payment apps

- Compliance with PCI DSS and GDPR

- Blockchain based financial applications

Why Choose Them:

ISO 9001 certified, recognized for innovative fintech solutions and high client satisfaction. Known for agile development, seamless integrations & delivering secure financial applications globally.

Client Testimonial:

Their structured approach, transparency and commitment to long term partnership made them truly impressive.

3. Armada Labs

Armada Labs is a specialized fintech software development company, with over 24 years of experience. They focus on digital wallet solutions, peer to peer lending apps and blockchain based financial platforms; Delivering secure, scalable and innovative fintech products.

Founded: 2002

Employees: 220

Projects Completed: 800+

Ratings: Clutch – 4.9 | DesignRush – 4.7

LinkedIn: armadalabs

Notable Clients: Paydit, QuickFee, Payline, PDS

Fintech Expertise:

- Digital wallets & mobile payment apps

- Peer to peer lending platforms

- Blockchain and cryptocurrency solutions

- Payment gateway integrations

- Regulatory compliance (PCI DSS, GDPR)

- Financial analytics and reporting platforms

Why Choose Them:

ISO certified and known for innovative fintech solutions, Armada Labs is recognized for agile processes, cost effective delivery and strong expertise in secure digital finance applications.

Client Testimonial:

We benefited by listening to what Armada Labs had to say. Trust their expertise.

4. SDK.finance

SDK.finance is a global fintech software development company specializing in core banking systems, digital wallets & payment gateway solutions. With a strong focus on scalability, security & compliance, They deliver enterprise grade financial software.

Founded: 2014

Employees: 40+

Projects Completed: 200+

Ratings: GoodFirms – 5.0

LinkedIn: sdkfinance

Notable Clients: Transactly, CompanyScouts

Fintech Expertise:

- Core banking systems

- Digital wallet development

- Payment gateway solutions

- Open banking APIs

- Compliance: PCI DSS and GDPR

- Fintech SaaS and mobile banking solutions

Why Choose Them:

Recognized for robust, scalable fintech platforms, SDK.finance combines agile methodologies, with strong regulatory compliance delivering secure and innovative solutions for startups and global enterprises alike.

Client Testimonial:

SDK.finance is highly secure, reliable and a perfect mobile ready solution.

5. Zymr

Zymr is a fintech software development company with a global presence Specializing in cloud based financial platforms, trading apps and payment integration solutions. They focus on delivering secure, scalable and innovative fintech software.

Founded: 2012

Employees: 400+

Projects Completed: 200+

Ratings: Clutch – 4.5 | DesignRush – 5.0

LinkedIn: zymr

Notable Clients: SoPact, Accelera

Fintech Expertise:

- Cloud based fintech platforms

- Trading and investment apps

- Payment integration solutions

- Digital banking and wallets

- AI driven financial analytics

- Compliance with PCI DSS and GDPR

Why Choose Them:

Zymr is recognized for innovative cloud-first fintech solutions with agile delivery, strong security and global compliance helping enterprises build robust and scalable financial software.

Client Testimonial:

What is unique about Zymr is that they have a very deep, technical bench strength in the technology.

6. DigiPrima Technologies

DigiPrima Technologies is a fintech software development company with 10+ years of experience focusing on mobile banking, blockchain solutions, AI driven finance apps and payment systems. They deliver secure, and scalable digital financial platforms.

Founded: 2016

Employees: 150+

Projects Completed: 750+

Ratings: Clutch – 5.0 | GoodFirms – 5.0 | DesignRush – 4.3

LinkedIn: digiprima

Notable Clients: Sitopia, Cilutions, Visuall

Fintech Expertise:

- Mobile banking and digital wallet apps

- Blockchain based financial solutions

- AI driven lending and investment platforms

- Payment gateway integration

- Compliance with PCI DSS and GDPR

- Financial analytics and reporting solutions

Why Choose Them:

ISO certified and known for secure, innovative fintech solutions, DigiPrima combines agile methodologies, with deep domain expertise delivering cost effective, scalable and compliant financial software globally.

Client Testimonial:

They've given us a professional website that's responsive and user friendly.

7. Zazz

Zazz is a fintech software development company specializing in fintech app development, payment solutions & digital banking platforms. They focus on delivering secure, user friendly and scalable financial software for startups and enterprises.

Founded: 2015

Employees: 200+

Projects Completed: 800+

Ratings: Clutch – 4.9 | GoodFirms – 5.0 | DesignRush – 5.0

LinkedIn: zazz

Notable Clients: EnZed Design, Accelex, BAST & Associates

Fintech Expertise:

- Fintech app development

- Payment gateway integration

- Digital banking solutions

- Mobile wallets and peer to peer payment apps

- Compliance with PCI DSS and GDPR

- Blockchain enabled financial applications

Why Choose Them:

Zazz is recognized for innovative & secure fintech solutions; leveraging agile development practices and regulatory compliance to deliver reliable, scalable and cost effective financial software.

Client Testimonial:

They took good care of us and treated us like any other client.

8. Newwave Solutions

Newwave Solutions is a fintech software development company with expertise in digital banking, lending platforms and payment gateway solutions. They focus on delivering secure, scalable & compliant financial software for global clients.

Founded: 2011

Employees: 300+

Projects Completed: 800+

Ratings: Clutch – 4.9 | GoodFirms – 5.0 | DesignRush – 5.0

LinkedIn: newwave-solutions

Notable Clients: Crane, JBA, VinID, Byju’s

Fintech Expertise:

- Digital banking solutions

- Lending and loan management platforms

- Payment gateway integration

- Financial SaaS solutions

- Regulatory compliance (PCI DSS, GDPR)

- Mobile wallets and fintech apps

Why Choose Them:

ISO certified and recognized for innovative fintech solutions, Newwave Solutions combines agile delivery, security and compliance expertise to build scalable, reliable and cost effective financial software.

Client Testimonial:

Working with Newwave Solutions was special because of their proactive attitude to problem solving.

9. Fulminous Software

Fulminous Software is a fintech software development company specializing in payment solutions, digital wallets and blockchain based financial platforms. They focus on creating secure, scalable and innovative fintech applications for startups, and enterprises.

Founded: 2019

Employees: 50+

Projects Completed: 90+

Ratings: Clutch – 5.0 | GoodFirms – 5.0 | DesignRush – 4.9

LinkedIn: fulminous-software

Notable Clients: Easyrecovery, Rivaasa, The Fund Advisor

Fintech Expertise:

- Payment processing and wallet development

- Blockchain based financial applications

- Mobile banking and lending platforms

- Compliance with PCI DSS and GDPR

- Fintech SaaS solutions

- AI driven financial analytics

Why Choose Them:

Recognized for secure and scalable fintech solutions, and combines agile methodologies with strong compliance expertise, delivering cost effective, innovative financial software for global clients.

Client Testimonial:

Fulminous Software's quick communication and easy going understanding team have been impressive.

10. Infograins

Infograins is a fintech software development company with expertise in digital banking, fintech SaaS solutions & payment gateway development. They focus on delivering secure, scalable and innovative financial software for global enterprises and startups.

Founded: 2011

Employees: 150+

Projects Completed: 1100+

Ratings: Clutch – 4.9 | GoodFirms – 5.0 | DesignRush – 4.9

LinkedIn: infograins

Notable Clients: XGen, AnChain.ai, Walkme, Brinc

Fintech Expertise:

- Digital banking platforms

- Payment gateways and wallets

- Fintech SaaS solutions

- Mobile banking and lending apps

- Regulatory compliance (PCI DSS, GDPR)

- AI driven financial analytics

Why Choose Them:

ISO certified and recognized for innovative fintech solutions, Infograins combines agile delivery, with strong security & compliance practices to build cost effective, scalable and reliable financial software.

Client Testimonial:

We were pleased with their skilled team and excellent communication.

Key Factors to Consider While Choosing a Fintech Software Development Partner

Selecting the right partner is crucial for the success, security and scalability of your fintech project. Consider these key factors:

- Experience in Fintech: Proven track record in digital banking, payments, lending or blockchain solutions.

- Technical Expertise: Proficiency in AI, ML, blockchain, cloud, mobile apps and API integrations.

- Regulatory Knowledge: Strong understanding of PCI DSS, GDPR and other global financial regulations.

- Portfolio & Case Studies: Evidence of successfully delivered fintech projects for startups and enterprises.

- Certifications & Awards: ISO, CMMI or industry recognition indicating reliability and quality.

- Security & Compliance: Focus on data protection, encryption and secure financial transactions.

- Agile & Transparent Processes: Clear communication, collaborative workflow and timely delivery.

- Post Launch Support: Ongoing maintenance, updates and scalability support after deployment.

💬 Community Insights

Quora users also highlight the importance of choosing fintech software developers with proven financial expertise, strong security practices, post launch support and positive client reviews, while maintaining a balance between cost and quality.

Conclusion

The fintech industry continues to redefine global finance through innovation, security and seamless digital experiences. As modern technologies like AI, blockchain and cloud computing mature, partnering with an experienced fintech software development company has never been more critical.

The right partner ensures compliance, scalability and user trust, key ingredients for success in today’s competitive financial ecosystem. Whether you’re a startup or an established enterprise, embracing fintech driven transformation is the path to staying ahead in the digital economy.

So Turn your Fintech Vision into Reality with eSparkBiz Expert developers, agile delivery and global compliance!

-

What is fintech software development?

It involves building digital financial solutions like banking apps, payment systems, lending platforms and blockchain applications.

-

How much does fintech software development cost?

Costs vary by project complexity, technology and partner location; rates can range from $12-$150/hour.

-

How long does it take to develop a fintech application?

Typically, 4-12 months depending on the project scope, compliance requirements and features.

-

What security standards should fintech apps follow?

PCI DSS, GDPR, encryption protocols and other regulatory requirements for safe financial transactions.

-

Can startups also hire these top fintech companies?

Yes, these companies cater to startups, SMEs and enterprises, providing scalable and budget friendly solutions.

-

Which are the best companies for fintech software development?

Some of the top fintech software development companies include eSparkBiz, Fingent , Armada Labs, SDK.finance, Fulminous Software and more. These firms specialize in digital banking, payment gateways, blockchain solutions, and AI-driven financial platforms.