Quick Summary :- If you are out to calculate the CAC for a SaaS company, this guide is for you. After giving a brief introduction to CAC, this guide discusses the formula of CAC and it is vital to understand the concept of CAC. Thereafter it discusses various models of CAC and other aspects of it. The guide ends with some FAQs to clear all your confusion.

Have you heard of SaaS? If so, you likely know about cloud technology and the various services it offers. Today, we’ll focus on calculating Customer Acquisition Cost (CAC) for a SaaS company.

SaaS, short for Software as a Service, is a cloud delivery model where services are provided via subscription. It allows third parties to offer applications over the internet without requiring local installation.

The global SaaS market was valued at USD 464.8 billion in 2025 and is expected to grow to USD 819.23 billion by 2030, expanding at a 12% CAGR, making efficient CAC management crucial for success.

Popular SaaS applications include:

If you’re planning to build a SaaS application for your business, hiring skilled developers can ensure efficient, cost effective solutions. Tracking CAC is essential for SaaS success, so let’s understand it thoroughly.

What Is Customer Acquisition Cost (CAC)?

Customer Acquisition Cost refers to the total expense a company invests to convert a potential buyer into a paying customer. It includes marketing, sales, operations and related efforts that influence how effectively a business attracts and secures new customers.

CAC reflects all direct and indirect costs such as campaigns, personnel, tools and resources used for customer outreach. Understanding this number helps companies measure profitability, refine strategies and decide whether the customers they attract bring sustainable long term value.

Why Understanding CAC is Vital?

When it comes to a business, the future of how things you are working out is unpredictable. You can’t be 100% sure of how well your customers or the audience, in general, would perceive the services that your company has to offer.

The same happens in SaaS companies as well. To be somewhat aware of the direction in which they might be dipping, many of the major SaaS companies rely on CAC calculations.

The CAC calculations can offer them with the approximate result for the number of customers that they would gain in the future. The company can then invest accordingly into resources to ensure that all of the predicted outcomes are met.

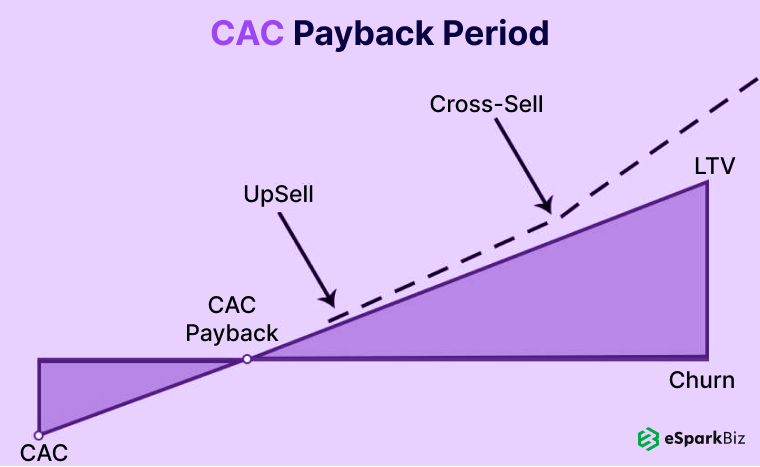

The CAC Payback Model

A model is derived from the data collected so that the companies can have a better understanding of the payback period.

One of the many good things about CAC is that it not only tells you about the cost to acquire a customer but also gives you an idea about the period that your customers would ideally need to pay back their CAC.

Key Reasons To Understand CAC

Now, after having told you about what CAC is and the fact that most of the SaaS companies utilize it, you might have certain questions like why is it so important to understand the cost of customer acquisition?

Listed below are the three key reasons to know why understanding CAC is important.

- Helps You Optimize LTV/CAC Ratio

A healthy LTV to CAC ratio ensures you earn more from each customer than you spend, helping maintain profitability and long-term business stability. - Determines CAC Payback Period

Knowing the CAC payback period helps you understand how long it takes to recover acquisition costs, making financial planning and growth forecasting easier. - Improves CAC Tracking and Optimization

Tracking CAC regularly helps you identify spending gaps, refine marketing efforts and improve customer conversions, resulting in better returns on your overall acquisition investment.

Why CAC Is Important For SaaS Business?

SaaS business is all about offering services to customers at a minimum rate.

The cost of goods and services in this business is not much, so the company can acquire as many customers as it can at a low yield. You also need to know about the SaaS Pricing Models.

They can then eventually earn a profit after providing months of services to the customer at a low yield. When compared to the LTV which is Lifetime value ratio, their relationship can be given by the equation:

LTV = 3 * CAC

So, as a customer acquisition cost example, if a company’s CAC is $100, then as per the equation, its LTV should be $300.

This can help a company decide how much it can spend against the value of an asset.

What to Include In CAC?

We have discussed what CAC is and how it is important for any SaaS company. But, what are the things that can be included in the cost of customer acquisition? And how would it affect the company or the CAC itself? Let’s find out.

The two factors that should be considered are:

- Sales and Marketing Expenses: Sales and marketing costs include salaries, incentives, software tools and campaigns. These expenses significantly influence CAC, so companies should count all investments made to attract and convert potential customers.

- New Customers Acquired: Including only newly acquired customers keeps CAC accurate and manageable. Counting every existing customer inflates costs, so focusing on fresh acquisitions provides a realistic measure of what each new customer truly costs.

💡 Did You Know?

Over 55% of businesses have adopted SaaS tools to optimize their websites, enhancing performance, user experience and overall digital efficiency.

What Not To Include In CAC?

We saw what should ideally be included by a company while using the customer cost calculator.

Some companies have made the mistake of not including some of the expenses that should have been a part of the CAC.

Not including these factors, led the company’s total expense and CAC calculations to go haywire.

The mistakes that were made by the companies are:

- Not Include Salaries : Salaries of your employees are a major part of your expense. Employees are the ones that spend time coming up with marketing strategies, so their efforts should be considered while calculating the CAC.

- Not Include Overhead : Any of the overheads like equipment or rent that were a part of the marketing process or that were used by the employees while working on marketing strategies should be considered as a part of the CAC.

- Not Include Money Spent on Tools: When you use marketing tools, it makes the entire process a lot more efficient. The amount spent on them should be a part of the CAC too.

How To Calculate Customer Acquisition Cost?

Now, when it comes to the question of how to calculate acquisition cost, we can say that it is dependent on two of the most important factors.

These factors include the customer acquisition cost formula and the success rate of the relationship between the CAC and the customer.

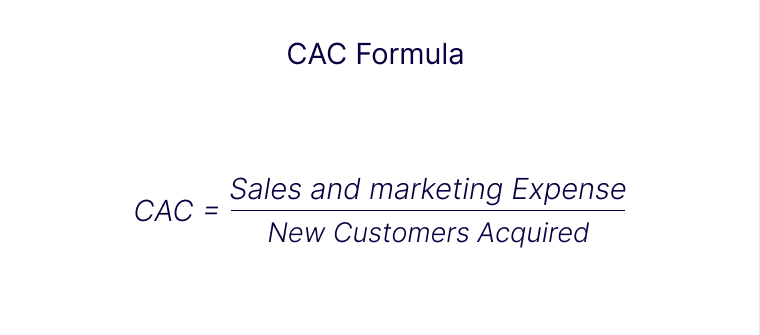

The CAC Formula

The use of CAC has been increasing over the years in internet-oriented companies. It is widely used in SaaS provider companies.

To put it into simple words, the CAC formula consists of the amount spent on gaining new customers divided by the number of customers gained.

Mathematically, the formula can be represented as

CAC= Total Cost of getting new customers/ Total number of new customers gained.

CAC & Customer Success

The success rate of a CAC to work efficiently depends on various factors.

The more successful and accurate the CAC is, the more it will help companies come up with strategies that can help them market their brand or products and services in a better way.

It can help them to know what they need to invest in order to increase the number of customers viewing or creating their profiles.

Understanding the LTV:CAC Ratio

LTV shows how much value a customer brings throughout their relationship with your company, while CAC measures the cost to acquire them. Using both together helps you understand profitability and how efficiently your sales and marketing efforts perform.

A strong LTV matters more than constantly increasing CAC because it reflects lasting customer relationships without extra spending. Balancing both metrics gives a clearer view of sustainable growth, allowing companies to prioritize long term value over short term acquisition costs.

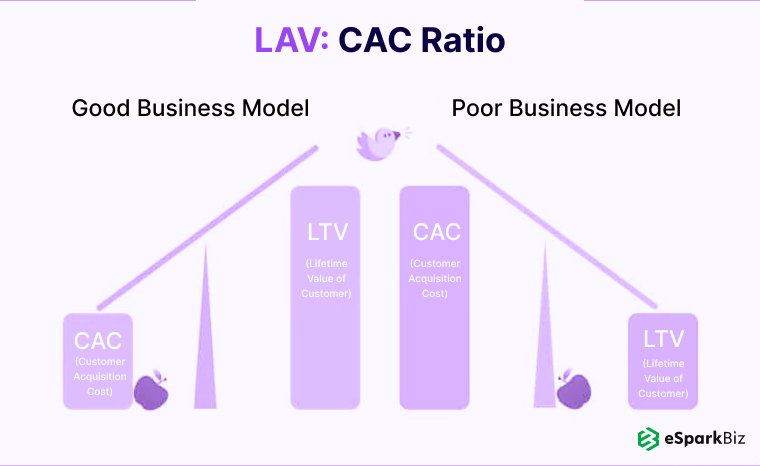

Understanding Both The Business Models

In the image given below, two business models have been shown. Both of them contain LTV and CAC but they aren’t the same.

One of them is titled as a good business model whereas the other is titled as a bad business model. So what caused this difference? The answer is right in front of you.

The first model focused more on the LTV than the CAC while the second model did the vice versa.

What happened here is that, by focusing more on the LTV, the company did not have to bear any extra expenses and the money that they spent was in small amounts and was easily recoverable. They also made more profit than they had expected.

On the other hand, the second model focused more on CAC and had to bear greater expenses that weren’t recoverable easily. They also couldn’t make much profit.

I hope you understand what the image portrays and focus on LTV rather than CAC.

A Different Perception for CAC

There can be different ways to approach CAC. According to the model formulated by Dave Kellog, instead of the ideal dollar value comparison to LTV, you can compare the expenditure from the sales and marketing department of your company to your newly generated revenues.

Using this alternative method or this new perception can tell you the effectiveness of your latest expenditures from the sales and marketing departments.

CAC Payback Period

CAC Payback Period shows how long it takes for a company to recover the money spent on marketing, sales and product development. These expenses are essential for building and launching SaaS products, making payback duration a key financial benchmark.

To calculate the CAC Payback Period, you need your CAC, Gross Margin Percent and Average Revenue per Account. The formula divides CAC by ARPA multiplied by gross margin, helping companies understand cash flow readiness and growth potential.

CAC Payback Period = CAC / (ARPA × Gross Margin Percent)

Calculating the Payback period has some pros and cons as well. They are as mentioned below:

Pros

- It helps to know the profit that you’d have to make.

- It helps to determine the capital efficiency, especially for a SaaS company.

- The company is likely to earn more profit if the payback period is less.

- It also helps to reduce the CAC.

Cons

- Need to use Relevant metrics

- Not tracking of every SaaS metric.

Gross Margin Adjusted CAC Payback Period

You can adjust the CAC as per your company’s gross margin. The amount that you spend as an expense should be less than or in balance with the profit or at least the income your company makes.

Once you determine the CAC, you can compare it with your company’s gross margin and then try to come up with strategies to reduce CAC and increase your profits.

Ways to Reduce the CAC

Less CAC means that your company won’t have to spend much on the expense. You can also say that less CAC means profit.

If your CAC is less, then the payback period to overcome that expense will become less. Some of the ways that you can implement to reduce CAC are:

- Optimize The Funnel: By optimizing the funnel, you can narrow down the number of visits to potential leads or customers.

- Optimize The Pricing Strategy: By optimizing your pricing strategy, you can reduce the CAC for your company. This would also result in a reduced payback period and an increased profit.

- Increase Efficiency of Sales & Marketing: CAC is all about marketing and sales, so focusing on the efficiency of these departments is necessary.

- Quickly Engage New Customers: New customers that you acquire should engage to the product in a less amount of time. This would increase the possibility of the customer to continue with the use of service.

- Inbound Marketing: Inbound marketing can help your business by offering ways to bring new leads via the funnel at minimal costs.

You as a company should aim to have a reduced CAC. Your main aim should be to reach out to people, acquire them as your customers, provide them with quality services, and eventually gain profits.

How CPA & CAC Are Different?

We had a look at the CAC.

Now let’s see what CPA is. Short for Cost per acquisition or cost per action, it is one of the metrics for marketing to measure the cost required for you to gain a customer for your company.

This customer would be willing to pay for the services that you have to offer.

There are many examples of the services that customer got under the CPA program. Some of them are as follows;

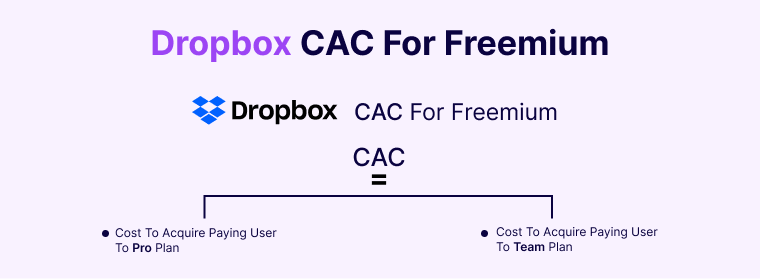

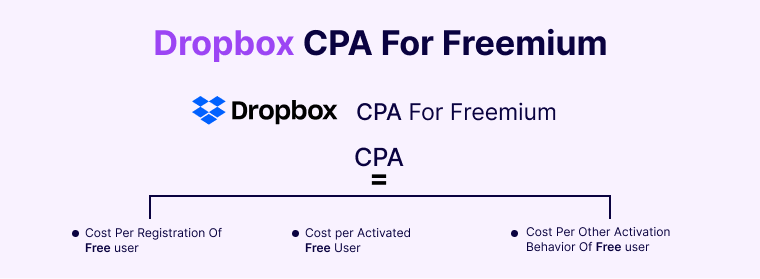

Dropbox

When it comes to the tasks and responsibilities, CAC and CPA are quite different from each other.

In the case of Dropbox, which is a hosting service for files and data, the CPA would include the registration cost for every free user and the cost for an activated free user.

This can help to know that a viewer of the service has become a user of the service.

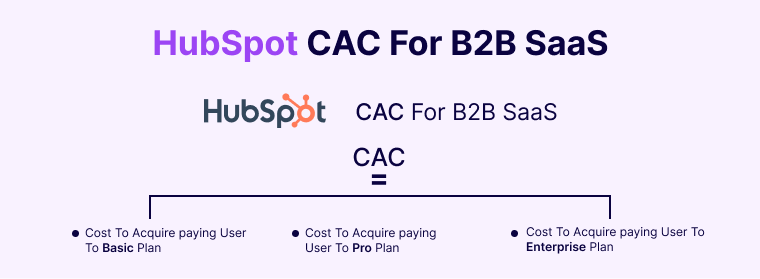

HubSpot

It is one of the companies that develop marketing, customer service, and sales products. The CPA for it would include trial cost, cost per lead, the cost for a qualified lead, and many more.

I’m sure that you are aware of Facebook, its purpose, and the features that it offers.

Now, looking from a business perspective, there might be certain strategies that it follows. Along with that, you use CPA for activated user cost, registration cost, etc.

How to Calculate CAC in Real-Time Scenario?

Finding out the probability of a system is fine but it is also necessary to implement it in the real-time scenario.

Companies, especially the ones in the software and computer field, have to keep up with the new technologies.

Ensuring efficiency in your work is an integral part of your responsibility as a SaaS provider company. So, how to calculate customer acquisition cost in scenarios like this?

We have an answer for that.

Freemium Product

Ever used a freemium product before? Well, it is a kind of software product or service offered by organizations. All the customers are eligible for using the basic features offered by the product.

If they want to upgrade their account or the service that they receive, then they will have to pay for that. Dropbox is one of the examples of a freemium product.

You don’t pay for Dropbox when you use it for the first time. If you use up all the storage offered by Dropbox, then you’ll have to pay for more storage that is offered by the organization.

SaaS Company

Many saas development services offer Third-party services even as collaboration.

Usually, they give you a free trial of the services that they have to offer, and then if you wish to upgrade your account plan, you can pay for the same.

Conclusion

The concept of CAC gives SaaS companies a clear view of how much they spend to gain each customer. When calculated correctly, it helps teams control spending, strengthen planning and build pricing strategies that improve long term business stability.

Understanding CAC, LTV and payback periods together allows companies to create sustainable growth without unnecessary expenses. With accurate numbers and consistent tracking, SaaS businesses can improve profitability, support smarter decisions and maintain stronger customer relationships over time.

Frequently Asked Questions

How do you calculate CAC SaaS?

CAC is calculated by the dividing total cost of acquiring customers by a given time period by the total number of customers acquired over that period of time.

How do you calculate LTV in SaaS?

LTV is calculated using:

- Average purchase value

- Purchase frequency

- Customer lifespan

Formula: LTV = Purchase Value × Frequency × Lifespan

What Is The Average Customer Acquisition Cost?

The customer acquisition cost varies from one industry to the other. But, the average for travel is $7, retail is $10 and customer good is $22.

What’s A Good Customer Acquisition Cost?

It is said by the marketing experts that if your LTV (Customer Lifetime Value) to CAC (Customer Acquisition Cost) ration is 3:1, then you’re in a very good position, without any doubts.!