Quick Summary :- This blog lists the top 100 startup accelerators in the USA categorized by general, university-based, corporate, impact-driven and international programs. It highlights funding opportunities, mentorship, global networks and growth support that help founders scale their businesses more quickly. Whether you are building a SaaS, fintech, healthtech or impact-driven startup this guide serves as a trusted resource to choose the right accelerator in 2025.

For early-stage founders choosing the right startup accelerator can make the difference between struggling to grow and scaling into a market leader. Accelerators provide more than funding but they offer mentorship, global networks, structured programs and investor access that can fast track success.

In this guide, we’ve compiled the top 100 startup accelerators & incubators in the USA for 2025 carefully categorized into general, university based, corporate, impact driven and international programs. Each accelerator brings unique strengths from fueling SaaS development and fintech ventures to supporting biotech, cleantech and social impact startups.

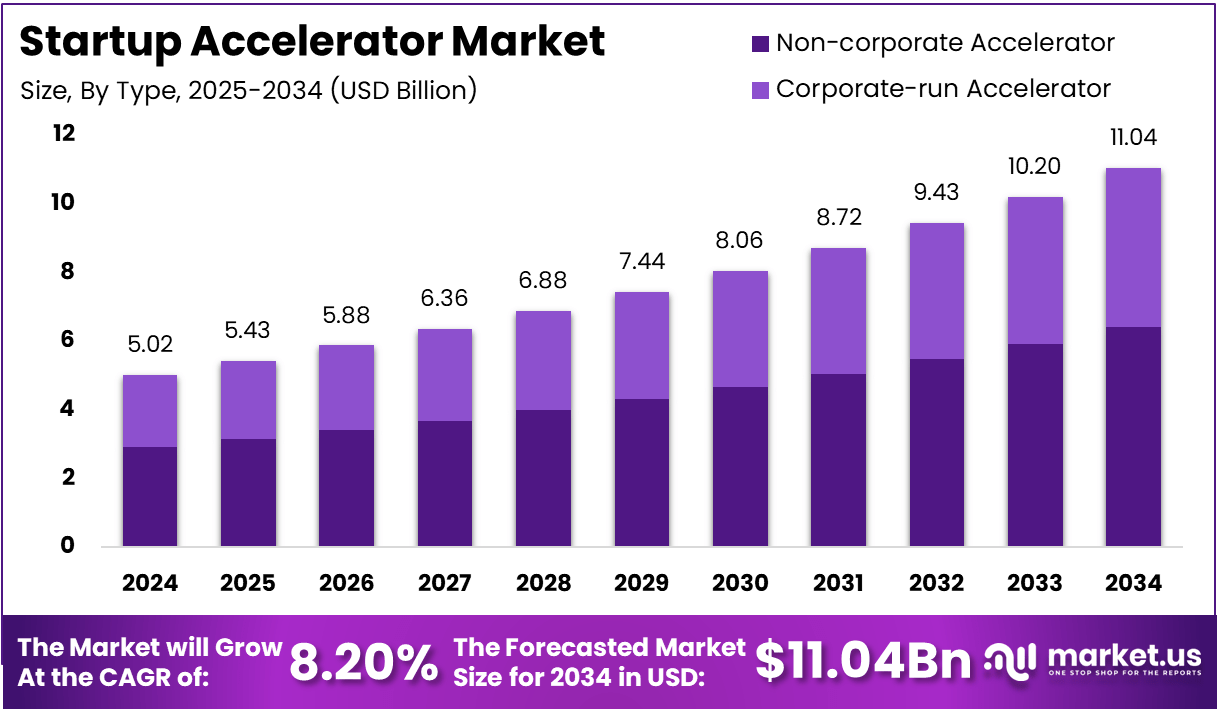

According to the Market.us Report, the Global Startup Accelerator Market is expected to be worth around USD 163.3 Billion By 2034 up from USD 5.02 Billion in 2024 and it is expected to grow at a CAGR of 8.20% from 2025 to 2034.

Whether you are an entrepreneur seeking funding, mentorship or market entry then this list will help you identify the best accelerator to match your vision and industry.

What Are Startup Accelerators & Incubators?

Startup Accelerators are short term intensive programs designed to scale early stage startups rapidly. They typically run for 3 to 6 months and provide seed funding and mentorship from industry experts with access to investor networks and structured guidance.

The goal is to help startups achieve quick growth, refine their business model and prepare for larger funding rounds. Well-known examples include Y Combinator, Techstars and 500 Startups.

Key Features of Startup Accelerators

- Fixed Duration – Usually 3 to 6 months designed for rapid growth

- Seed Funding – Provides initial capital in exchange for equity

- Mentorship & Networking – Access to investors, industry leaders and alumni networks

- Demo Day – Startups pitch to potential investors at the program’s end

Startup Incubators on the other hand focus on nurturing raw business ideas and supporting entrepreneurs at the earliest stage of development. Unlike accelerators, incubators are not time bound.

They offer co-working space, long-term mentorship, training and access to resources like legal or technical support. Incubators often partner with universities, governments or non profits to help startups build a strong foundation before seeking investment.

Key Features of Startup Incubators

- Idea Stage Support – Helps entrepreneurs validate and develop concepts into viable businesses

- Flexible Duration – No strict timelines; support can last months or even years

- Resources & Workspace – Office space, shared infrastructure, legal/technical support

- Partnerships & Ecosystem – Often linked with universities, research centers or local governments.

Accelerators is speed & funding for early stage startups while Incubators is nurturing ideas into startups with long term support.

How Can Startup Accelerators & Incubators Help You in Business?

Startup accelerators and incubators act as growth catalysts for entrepreneurs by offering the right mix of funding, mentorship and resources. Whether you are just shaping your idea or preparing to scale these programs can help you overcome early challenges and build a sustainable business.

1. Access to Funding & Investors

Accelerators often provide seed funding in exchange for equity and connect startups to a wide network of venture capitalists, angel investors and funding opportunities. Incubators may not directly fund but can help secure grants or connect you with financial institutions.

2. Expert Mentorship & Guidance

Both incubators and accelerators pair entrepreneurs with experienced mentors, industry leaders and advisors. This guidance helps refine your business model, go to market strategy and digital product development.

3. Networking & Ecosystem Benefits

Programs create strong peer to peer networks where startups can collaborate, share insights and form partnerships. Access to alumni, investors and corporate partners boosts credibility and visibility.

4. Skill Development & Training

Incubators often provide workshops on business planning, product design, marketing, legal compliance and fundraising. Accelerators focus more on growth hacking, scaling strategies and pitch preparation.

5. Reduced Risk & Faster Growth

By combining resources, structured programs and expert guidance, incubators and accelerators reduce the trial and error phase and increase your chances of long term success.

In short: Startup accelerators fast-track growth with funding and mentorship, while incubators nurture ideas with long-term support and resources together they significantly improve your chances of building a scalable business.

🧠 DID YOU KNOW

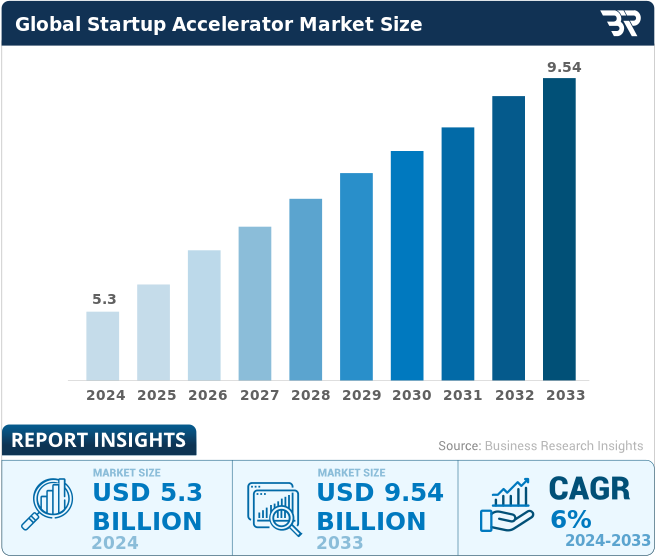

The Startup Accelerator Market valued at USD 5.3 Billion in 2024 and is forecasted to grow consistently reaching USD 5.62 Billion in 2025 and ultimately achieving USD 9.54 Billion by 2033 at a steady CAGR of 6%.

Best Startup Accelerators & Incubators in the USA

Drive through the most impactful startup accelerators and incubators in the USA, driving innovation, funding opportunities, mentorship and scalable growth for emerging entrepreneurs and early stage ventures.

1. Y Combinator (YC)

Based in Silicon Valley, Y Combinator is arguably the most influential startup accelerator in the world. Since 2005, it has supported over 4,000 companies that collectively reached a valuation of more than $600 billion. Startups like Airbnb, Dropbox, Stripe, Reddit and Coinbase all started here.

YC invests $500,000 in every company with $125,000 for 7% equity and $375,000 on an uncapped SAFE with MFN. Its program lasts 3 months during which founders receive intense mentorship, access to a world-class alumni network and opportunities to pitch to top-tier investors during Demo Day. YC’s brand itself carries massive credibility which is often enough to open doors to funding and partnerships.

- Founded: March 2005

- Location: San Francisco, California, USA

- Funding: YC startups have raised over $800 billion in combined valuation.

- Equity: Typically invests around 7% equity for $500K seed funding.

- Alumni: Airbnb, Dropbox, Stripe, Reddit, Coinbase, Instacart, Twitch and many more.

2. Techstars

Techstars operates accelerator programs in more than 15 cities worldwide and is known for its strong global network. Since 2006, it has funded over 3,600 startups that together have raised $27 billion in funding. Notable alumni include SendGrid with IPO later acquired by Twilio for $3B, DigitalOcean and ClassPass.

Each program offers $20,000 in seed funding plus a $100,000 convertible note, mentorship and access to 7,000+ mentors, partners and alumni. Techstars is especially valuable for founders who want global exposure and connections across industries.

- Founded: 2006 (first program in 2007)

- Location: HQ moved to New York City (originally Boulder, Colorado), global reach

- Funding: Alumni have raised over $30.1 billion in total funding; $127.7 billion in cumulative market cap.

- Equity: Historically around 6% equity for $20K plus safe, though varied.

- Alumni: Uber, Twilio, SendGrid, DigitalOcean, PillPack, ClassPass, Remitly, GrabCAD, Trust & Will, SketchFab, etc.

3. 500 Startups (now 500 Global)

500 Global has a strong presence in Silicon Valley but also runs programs worldwide. Since 2010, they have backed more than 2,800 companies across 75+ countries including Canva, Udemy, Grab and Credit Karma.

Their accelerator provides $150,000 investment for 6% equity. Beyond capital, 500 is known for its rigorous growth hacking curriculum, marketing expertise and access to a vast investor pool. It’s especially well-regarded for international startups seeking entry into the U.S. market.

- Founded: 2010 (as 500 Startups)

- Location: Based in San Francisco, California

- Funding: (Total fund size collectively across multiple funds; not program seed info)

- Equity: (Varies by program; not publicly specified)

- Alumni: Not detailed in available sources for alumni (beyond general portfolio)

4. MassChallenge

Based in Boston with global branches, MassChallenge is a non-equity accelerator that supports startups across all industries. Founded in 2009, it has supported 4,000+ startups that raised over $9 billion in funding.

Its USP is equity-free funding, massive corporate partnerships and global reach. Notable alumni include Ginkgo Bioworks and Cognate BioServices. The program provides mentorship, office space and exposure to investors without taking equity ideal for founders who want resources while retaining control.

- Founded: 2009

- Location: Headquartered in Boston, Massachusetts

- Funding: Alumni have raised $8.6 billion in funding and created over 186,000 jobs.

- Equity: Offers zero-equity programs; uses a competition-based model with cash prizes.

- Alumni: JoyTunes, Her Campus, LiquiGlide, Ministry of Supply, RallyPoint, Moneythink and more.

5. AngelPad

Based in New York and San Francisco, AngelPad has worked with more than 150 companies each raising an average of $14M in funding. Ranked the #1 U.S. Accelerator by MIT’s Seed Accelerator Benchmark for several years, it has produced hits like Postmates (acquired by Uber) and Coverhound.

Every 6 months, AngelPad selects around 15 teams for its 3-month program, offering seed funding, deep mentorship and strategic guidance. Founders benefit from help on product-market fit, investor readiness and connections to top VCs.

- Founded: 2010

- Location: San Francisco, California

- Funding: AngelPad alumni in aggregate have raised $2.2 billion+; average funding ~$14 million per company.

- Equity: Typically invests around $100–120K per startup; specifics vary by cohort.

- Alumni: Buffer, Postmates, Fieldwire, Spotsetter, Sensor Tower, Periscope Data, Beamery, etc.

6. StartX (Stanford)

StartX is a Stanford-affiliated non-profit accelerator and founder community. It has supported 1,500+ founders and 700+ companies raising more than $26 billion in funding. Alumni include Lumos, Patreon and Branch Metrics.

Unlike traditional accelerators, StartX doesn’t take equity. Instead it provides mentorship, investor access and a powerful Stanford founder community. Startups can also receive investment from the Stanford-StartX Fund which co-invests alongside VCs.

- Founded: 2011

- Location: Based in Stanford, California

- Funding: (Not an investor; supports via resources but doesn’t directly fund startups)

- Equity: Equity-free – no equity taken.

- Alumni: WifiSlam (acquired by Apple), Alphonso Labs (Pulse app), plus a broad startup community from Stanford.

7. LAUNCH (Jason Calacanis)

Founded by angel investor Jason Calacanis, LAUNCH Accelerator in San Francisco has produced unicorns like Tonal, Calm and Superhuman. Calacanis himself is known for early bets on Uber and Robinhood.

The 12-week program invests $100,000 for 6% equity and focuses heavily on customer acquisition and fundraising. Startups also get access to the LAUNCH founder community and demo opportunities in front of Jason’s investor network.

- Founded: 1998

- Location: Berkeley, California

- Funding: Invests $125K in startups for ~7% equity.

- Equity: ~7% for the accelerator investment.

- Alumni: Not explicitly listed; part of the ecosystem from UC Berkeley entrepreneurship.

8. Boomtown Accelerators

Based in Boulder, Colorado, Boomtown runs a 12-week accelerator with an emphasis on hardware, healthtech and AI startups. They provide up to $35,000 in seed funding plus $1.7M in perks from partners.

Their hands-on mentorship and focus on founder wellbeing sets them apart. Alumni include Stedi (API infrastructure) and several high-growth healthcare startups. Boomtown also has strong ties with Comcast NBCUniversal for corporate innovation programs.

- Founded: Not explicitly identified in sources.

- Location: Colorado (based on original listing).

- Funding / Equity / Alumni: Not clearly available in accessible sources.

9. Gener8tor

Gener8tor runs accelerators in multiple U.S. cities and is ranked among the top accelerator networks in the Midwest. It invests $100,000 into 5 startups per cohort with notable alumni including EatStreet and Bright Cellars.

What makes Gener8tor unique is its broad program reach besides tech, it also supports arts, music and social impact startups. Its high acceptance standards (only ~1–2% of applicants get in) ensure strong peer cohorts and alumni credibility.

- Founded: June 2012

- Location: Madison, Wisconsin

- Funding: Alumni have raised over $1.6 billion+ in follow-on financing.

- Equity: Offers $20K for 6–7% equity, plus $80K via uncapped convertible note (no board seats).

- Alumni: 800+ startups; Known alumni include PrettyLitter, EatStreet, Bright Cellars, Rentable, Allergy Amulet, etc.

10. Forum Ventures (formerly Acceleprise)

Forum Ventures is focused specifically on B2B SaaS startups. Based in San Francisco, New York and Toronto, it has backed over 200 companies since 2014 including DocSend (acquired by Dropbox) and Allbound.

It invests $100,000 in exchange for equity and provides 4 months of mentorship, sales coaching and SaaS-focused networking. For early-stage SaaS founders, Forum Ventures offers laser-focused expertise that few accelerators can match.

- Founded: 2014

- Location: New York City, US

- Funding: $3.5M (2015) → $7M (2017) → $30M (2021 launch) → $100M+ AUM (2025).

- Equity: $100K for 7.5% via post-money SAFE; includes $100K+ in perks.

- Alumni: ~500 portfolio companies; alumni raised $1B+ in follow-on funding.

If you are not embarrassed by the first version of your product, you’ve launched too late.

This resonates beautifully with the fast-paced, learn-by-doing ethos common to startup accelerators shipping early, iterating quickly and embracing imperfection as a catalyst for growth.

11. Newchip Accelerator

Austin-based Newchip Accelerator is a global online accelerator that has helped thousands of startups raise funding without requiring relocation. Since its founding, it has worked with companies across 35+ industries and 50+ countries. Its portfolio includes early-stage ventures in fintech, health, SaaS and consumer products.

Newchip offers programs lasting 3 to 6 months, focused on fundraising readiness, pitch training and investor access. Unlike traditional accelerators, it does not take equity upfront but charges program fees.

Startups benefit from mentorship, global investor networks and a structured path to securing seed or Series A funding, making it attractive for founders seeking remote scalable support.

- Founded: 2016

- Location: Based in Austin, Texas

- Funding / Alumni: Over 2,500 portfolio companies; alumni have raised more than $2.2 billion in total

- Equity: Offers equity-free program (though earlier reports suggest variations)

- Alumni: Graduates’ startups have collectively raised over $300 million since 2019, with over 70% successfully securing capital.

12. Village Capital

Founded in 2009, Village Capital is a Washington, D.C.-based accelerator and venture capital organization focused on solving global challenges. It has supported over 1,400 startups across 28 countries helping them raise more than $5 billion in follow on capital. Notable companies include Chipper Cash, Fintual and Paysail.

What sets Village Capital apart is its unique “peer-selected investment model,” where entrepreneurs evaluate one another and decide who receives funding. Programs typically focus on sectors like fintech, climate, health and the future of work.

Village Capital offers seed funding, mentorship and strong partnerships with global foundations and impact investors making it ideal for mission-driven startups.

- Founded: 2009

- Location: U.S.-based programs with global operations across the Americas, Africa and Asia.

- Funding / Alumni: Over 897 startups supported across 43 U.S. states; alumni have created over 11,102 jobs, served 6 million customers and offset over 50 million pounds of CO₂.

- Equity: Funding models vary and include equity-free grants or investments depending on the program, often peer-selected

- Alumni: Focuses on impact-driven entrepreneurs across financial health, social justice, energy and agriculture sectors

13. Founders Factory

Based in London, Founders Factory is a global startup studio and accelerator that has backed over 300 startups since 2015. It partners with major corporations like L’Oréal, Aviva, EasyJet and Guardian Media Group to co-build and scale startups. Its portfolio spans sectors such as beauty tech, fintech, health, media and climate.

Founders Factory invests cash, provides hands-on operational support and gives startups access to corporate partners for pilot opportunities. Its accelerator program typically runs for 6 months focusing on product validation, growth and fundraising.

The studio arm even co-founds startups from scratch. This hybrid model makes Founders Factory a powerful choice for entrepreneurs seeking both capital and corporate connections.

- Founded: Early 2010

- Location: Global programs with headquarters in London and outreach in various regions

- Funding / Alumni: Runs a portfolio of 300+ startups with notable exits; known alumni include Storyblok, Monolith AI, Perlego, Scan.com, Dronamics

- Equity: Takes typically 1–7% equity in exchange for capital, services (worth ~£220K) and hands-on support

- Alumni: Success stories include Perlego (later Series A funding), Scan.com, Dronamics and Storyblok.

14. TechNexus Venture Collaborative

Headquartered in Chicago, TechNexus Venture Collaborative blends the roles of venture investor, incubator and corporate innovation partner. Since 2007, it has invested in and accelerated more than 900 startups in industries like media, fintech, climate, sports and industrial tech. Portfolio companies include Cameo, Audio Analytic and AON-backed ventures.

TechNexus uniquely connects startups with Fortune 500 companies for joint ventures, pilots and long-term strategic growth. Programs emphasize collaboration, enterprise adoption and scaling through corporate distribution channels.

With a strong focus on venture capital plus ecosystem-building, TechNexus is ideal for startups aiming to secure both funding and enterprise-level partnerships.

- Founded: 2005

- Location: Chicago, Illinois

- Funding / Model: Operates as a Venture Collaborative using corporate partnerships, venture funds and venture-building to accelerate startups

- Equity: Not publicly specified (model focuses on venture collaboration rather than standard accelerator terms)

- Alumni / Impact: Has initiated hundreds of collaborations between corporations and startups through its ecosystem

15. Coplex

Coplex based in Phoenix is a venture builder that partners with industry experts, enterprises and entrepreneurs to launch startups. Unlike traditional accelerators, it focuses on co-founding companies from the ground up, particularly in healthtech, cleantech and enterprise software development. Since its founding, Coplex has helped launch 300+ ventures.

Its programs emphasize rapid validation, MVP development and investor readiness. Instead of just mentorship, Coplex provides hands-on support in product design, business strategy and fundraising.

By combining venture building with accelerator elements, it enables entrepreneurs especially non-technical founders to transform big ideas into scalable investment ready businesses.

- Founded: 2015

- Location: Scottsdale / Phoenix, Arizona

- Funding / Alumni: Operates a $5 million accelerator fund (launched 2017); helped launch ~48 startups annually; notable success includes Pluto TV (valued >$140M)

- Equity: Requires a program fee of $150K in 3 payments, in exchange for a 5% warrant in the company

- Alumni: Built ventures like Pluto TV and others via its structured startup studio model.

16. Entrepreneurs Roundtable Accelerator (ERA)

Located in New York City, ERA is one of the city’s leading accelerators, supporting 300+ startups since 2011. Its alumni have raised over $1 billion in capital, with notable successes like TripleLift, Glia and CardFlight. ERA has strong roots in NYC’s tech ecosystem, offering unparalleled access to investors and corporate partners.

ERA invests $150,000 in exchange for 6% equity and runs a 4 month program. Startups benefit from mentorship, office space, fundraising support and an extensive network of over 1,000 mentors and investors.

With deep ties to the NYC business community, ERA is especially suited for founders seeking traction and funding in one of the world’s top startup hubs.

- Founded: 2011

- Location: New York City

- Funding / Alumni: Invested in 280 to 300+ startups; alumni have raised more than $1 billion, with over $6 billion in market cap collectively; ERA-backed companies have raised over $2B and valued at $10B+ as of 2024.

- Equity: Offers $100,000 for 8% equity along with ~$100K worth of perks like credits, services and office space.

- Alumni: Notable resource-heavy accelerator with broad support (credits, mentorship, Demo Day) for each company.

17. Capital Factory

Based in Austin, Capital Factory is Texas’ most prominent startup accelerator and community hub. Since 2009, it has supported thousands of entrepreneurs and connected them to the state’s biggest network of investors, mentors and corporations. Notable alumni include Aceable, WP Engine and The Zebra.

Capital Factory offers a year-round accelerator program providing mentorship, co-working and investor access. It also runs a venture fund and connects startups with military and government contracts.

With Austin’s booming tech scene, Capital Factory is ideal for founders who want to scale in Texas and leverage strong public-private partnerships for growth.

- Founded: 2009

- Location: Austin, Texas

- Funding: Backed 750+ portfolio companies across seed to exit, offering venture capital funds, mentor network, coworking and events.

- Equity: Standard VC/accelerator terms not publicly specified; focus is on community, network and All Access Fund.

- Alumni: Broad startup community with access to meetups, mentors, competitions and an All Access Fund for startups.

18. Amplify.LA

Amplify.LA, based in Los Angeles is a seed-stage accelerator and venture fund that has backed 100+ startups since 2011. Its portfolio includes successful companies like Clutter, The Flex Company and Maple Media. Amplify focuses on early-stage founders looking to scale quickly in the competitive LA ecosystem.

The program invests between $50,000 to $250,000 and provides office space, mentorship and fundraising guidance. Startups also gain access to Amplify’s network of investors and corporate partners.

With its strong track record and LA roots, Amplify.LA is a great fit for founders building consumer, media and tech startups aiming for fast traction.

- Founded: Around 2011

- Location: Venice (Silicon Beach), Los Angeles, California

- Funding: Provides seed funding and workspace; funding raised ~$4.5M (crowdsourced data).

- Equity: Offers up to $50,000 in seed funding, free workspace, mentorship and discounted services in exchange for equity (specific percentage not disclosed).

- Alumni: Supports early-stage founders; notable for its presence in LA’s tech ecosystem.

19. Mucker Capital

Mucker Capital, headquartered in Santa Monica, operates both as a venture fund and accelerator. Since 2011, it has backed companies like Honey (acquired by PayPal for $4B), ServiceTitan and Emailage. It is recognized as one of the most founder-friendly programs in the U.S. Unlike traditional accelerators, Mucker runs a rolling, long-term program with no set batch dates. It invests early (pre-seed to Series A) and provides deep hands on operational support.

Its unique flexibility and focus on building enduring companies make it a top choice for startups that want patient, engaged investors rather than time-bound programs.

- Founded: 2012

- Location: Santa Monica (Venice), Los Angeles, California

- Funding: Manages VC funds (e.g., Mucker III – $45M); alumni raised $350M+ via MuckerLab.

- Equity: $250K–$750K seed; < $100K pre-seed; typical equity between 7–12% (up to 15%).

- Alumni: The Black Tux, ServiceTitan, Surf Air, Retention Science, BloomNation.

20. Plug and Play Tech Center

Silicon Valley-based Plug and Play is one of the largest global innovation platforms with over 50+ accelerator programs worldwide. Since its founding in 2006, it has accelerated 3,000+ startups including unicorns like PayPal, Dropbox, N26, Rappi and LendingClub.

Plug and Play runs vertical-specific accelerators in fintech, health, mobility, supply chain and more. Startups receive mentorship, pilot opportunities with 500+ corporate partners and access to Plug and Play’s venture arm for funding.

With its massive international reach and corporate innovation focus, it is an excellent choice for startups seeking global scale and enterprise partnerships.

- Founded: 2006

- Location: Sunnyvale, CA (HQ)

- Funding: Ecosystem includes 75,000+ startups; estimated revenues $70M+ annually; 1,600+ investments.

- Equity: Program funding ranges $50K–$250K; equity terms vary by vertical and cohort.

- Alumni: PayPal, Dropbox, LendingClub, N26, SoundHound, Honey, Zoosk etc.

21. Google for Startups

Google for Startups is a global initiative that connects entrepreneurs with Google’s resources, community and mentorship to help them scale. With startup campuses and partner hubs worldwide, it provides access to Google’s tools, products and experts. The program emphasizes inclusion, supporting underrepresented founders in tech.

Startups gain cloud credits, technical guidance, networking opportunities and credibility from Google’s backing. Its partnerships with accelerators and VC firms open valuable funding channels. For founders aiming for global growth, Google for Startups offers unparalleled visibility, connections and technology support.

22. Pioneer Fund

Pioneer Fund is a venture capital firm founded by over 100 Y Combinator alumni who pool resources to invest in and mentor startups. Since 2016, it has funded more than 200 companies across industries leveraging the YC network’s expertise and connections. Startups gain mentorship from experienced founders, introductions to top investors and insights on scaling.

Its unique model combines capital with founder-led support creating a strong community-driven accelerator alternative. By joining, founders access YC-style guidance even if they’re not part of the official program making it an attractive option for early-stage startups.

23. Startup Wise Guys

Startup Wise Guys is one of Europe’s leading B2B accelerators with a strong track record of supporting SaaS, Fintech, Cybersecurity and Sustainability startups. Headquartered in Estonia, it has accelerated over 400 companies from 60+ countries since 2012.

The program offers €65,000 to €100,000 in funding, intensive mentorship and access to a network of 250+ investors and 600+ mentors.

With a hands-on approach, it focuses on sales, product-market fit and international expansion. Demo Days attract top European investors. For startups looking to break into the EU market, Wise Guys provides expertise, capital and regional reach.

24. Startupbootcamp

Startupbootcamp is a global network of industry-focused accelerators operating in over 20 cities worldwide. It runs specialized programs in Fintech, HealthTech, Smart Cities and more tailored to each sector’s needs.

Since 2010, it has supported 1,200+ startups helping them raise more than $2 billion in funding. Startups receive mentorship from 1,500+ industry experts, office space, access to corporate partners and up to €50,000 in initial funding.

The program culminates in a high-profile Demo Day with global investors. Startupbootcamp’s global reach and corporate connections make it ideal for startups aiming to scale internationally.

25. gBETA

gBETA is a free, seven-week pre-accelerator program run by gener8tor, designed for early-stage startups. It accepts five companies per cohort, ensuring personalized mentorship and guidance.

Startups receive introductions to investors, customers and mentors without giving up equity. With programs across the U.S. and Canada, gBETA helps founders refine their business models, improve pitches and prepare for accelerators or funding rounds.

Alumni often move on to gener8tor’s full accelerator which offers investment. For first-time founders seeking validation and traction, gBETA is an excellent entry point to structured startup support.

Reddit Insights-

r/startups– Highlighting the real impact of an accelerator through a founder’s personal experience-

“My experience was entirely worth it. I learned more in those three months about running a business than I did in the five years prior when I was actually running a business. It introduced me to other founders that I am still in contact with 13 years later… I still have contact with the investors I met during that time.”

This firsthand account illustrates how accelerators can accelerate learning, forge enduring networks and open doors with investors an ideal real-world complement.

26. Orbit Startups

Orbit Startups is an accelerator that supports growth-stage startups in emerging markets, particularly Asia. It focuses on companies solving critical problems in fintech, ecommerce, logistics and sustainability.

Orbit provides funding, mentorship and access to investors, while leveraging its strong presence in fast-growing markets like India, Southeast Asia and China.

The program emphasizes scaling, helping companies expand regionally and globally. With a vast alumni network and strong ties to corporates, Orbit is especially attractive for founders seeking rapid growth in underserved markets.

27. Entrepreneurs First (EF)

Entrepreneurs First is a unique talent investor and accelerator that focuses on individuals rather than existing startups. Based in London with global offices, EF helps talented people find co-founders and build startups from scratch. It has supported over 600 companies, raising billions in funding.

EF invests in individuals, providing stipends, mentorship and introductions to investors. Its six-month program is designed to match entrepreneurs, validate ideas and create high-growth companies. For aspiring founders without a team but with ambition and talent, EF offers a proven pathway to launch a world-class startup.

Also Read: Why CTOs Are Moving from In-House Teams to Offshore AI Software Specialists?

28. NEXT Canada

NEXT Canada is a national nonprofit accelerator program that helps Canadian entrepreneurs scale globally. It offers three core programs like Next 36, Next AI and Next Founders focused on leadership, innovation and technology. Since 2010, it has supported over 600 entrepreneurs who collectively raised billions in funding.

Participants gain mentorship from global experts, access to top-tier investors and collaboration opportunities with leading corporations. Its Artificial Intelligence focused program is particularly attractive for tech startups. For Canadian founders seeking global competitiveness, NEXT Canada provides training, funding and a powerful network.

29. Expert DOJO

Expert DOJO is a Santa Monica-based accelerator and early-stage venture fund that focuses on international founders scaling into the U.S. market. It invests $100,000 to $250,000 per startup and provides mentorship, marketing support and access to investors. Since its founding, Expert DOJO has invested in 200+ companies from over 50 countries.

The program emphasizes growth hacking, helping startups build traction and scale quickly. It also hosts pitch events with top-tier investors. For global startups seeking U.S. market entry, Expert DOJO offers funding, expertise and valuable connections.

30. Sting

Sting is a leading startup accelerator based in Stockholm, Sweden supporting early-stage tech companies since 2002. It has backed over 400 startups across health, sustainability, fintech and deeptech sectors. Sting offers up to €500,000 in investment coaching from 100+ business coaches and access to a network of investors and corporates.

Its six-month program focuses on scaling globally, product development and market entry. Startups also benefit from office space and legal/financial support. Recognized as one of Europe’s top accelerators, Sting is ideal for ambitious founders targeting international growth.

31. Rockstart

Based in Amsterdam, Rockstart is a global accelerator-VC supporting startups in Energy, AgriFood and Emerging Tech. Since 2011, it has invested in over 350 startups across 30+ countries with a portfolio valued at more than €1 billion. Notable alumni include Bringly and iClinic.

The program provides initial funding up to €100,000 along with office space, expert mentorship and access to Rockstart’s investor and corporate networks. Their focus on impact-driven innovation ensures startups not only scale financially but also contribute to solving global challenges. With Demo Days across Europe, founders gain exposure to global investors and strategic partners.

32. 100Unicorns

100Unicorns is a venture studio and accelerator focusing on early-stage startups in SaaS, FinTech, HealthTech and Consumer Tech. The program has been instrumental in helping hundreds of founders launch scalable software product and secure seed-stage funding.

100Unicorns provides up to $250,000 in capital, mentorship from serial entrepreneurs and direct access to VC partners and angel investors. Its structured 12 week program emphasizes product-market fit, growth strategies and fundraising.

With a strong global mentor pool, 100Unicorns positions itself as a launchpad for startups aiming to scale rapidly and build sustainable businesses with unicorn potential.

33. Betaworks

Based in New York City, Betaworks is a startup studio and seed-stage venture fund known for building and investing in internet-first companies. Since 2008, it has incubated products like Giphy, Dots and Bitly while funding over 150 startups across media, Generative AI and consumer tech.

Betaworks offers pre-seed investments, co-building opportunities and a unique accelerator model called “Betaworks Camps,” which runs thematic programs around areas like voice, AR and AI.

Founders benefit from hands-on product development support, access to a creative tech community and connections to top investors. Betaworks is ideal for founders seeking early traction in disruptive digital markets.

34. The FIS Fintech Accelerator

Based in Little Rock, Arkansas, The FIS Fintech Accelerator is backed by Fortune 500 financial technology leader FIS and The Venture Center. It has supported more than 80 fintech startups with many securing pilot programs and partnerships with global banks.

The 12-week program offers funding, mentorship from financial services experts and direct access to FIS’s global network of clients and partners. Startups gain opportunities for real-world testing, regulatory insights and enterprise-level scaling.

With strong corporate backing and a focus on fintech innovation, the program is a proven gateway for startups targeting the financial services industry.

35. Acceleprise

Based in San Francisco, Acceleprise is a leading B2B SaaS accelerator and venture fund. Founded in 2012, it has invested in 200+ SaaS startups worldwide including companies like Trusted Health and GoSite.

The program provides $50,000–$100,000 in funding, a 4-month accelerator with hands-on mentorship and a strong focus on enterprise sales, growth marketing and fundraising. With hubs in San Francisco, New York and Toronto.

Acceleprise gives founders access to a global SaaS community, top-tier mentors and introductions to enterprise customers and investors. Its alumni have collectively raised over $1 billion in follow-on funding.

36. Quake Capital Partners

Based in Austin, Texas, Quake Capital Partners is a seed-stage accelerator and venture fund that invests across diverse industries including AI, FinTech, HealthTech and Consumer Goods. Since its launch, Quake has invested in 200+ companies with high growth potential.

Startups receive an initial investment of up to $200,000, access to Quake’s 12-week accelerator and mentorship from a network of 300+ industry experts. The program emphasizes scalable business models, customer acquisition and fundraising preparation.

With Demo Days in major cities, Quake gives startups visibility among VCs, angels and strategic investors making it a strong choice for early-stage founders.

37. Capital Innovators

Based in St. Louis, Missouri, Capital Innovators is consistently ranked among the top accelerators in the U.S. Since 2011, it has supported over 150 companies across industries with alumni raising more than $400 million.

The program provides $50,000 in seed funding, 12 weeks of intensive mentorship and access to corporate partners in healthcare, finance and technology. Startups benefit from office space, investor introductions and growth-focused programming.

With its strong reputation in the Midwest and beyond, Capital Innovators is particularly appealing for startups seeking a powerful launchpad and direct corporate engagement.

38. RSE Ventures

Based in New York, RSE Ventures is a venture capital firm founded by Miami Dolphins owner Stephen Ross and entrepreneur Matt Higgins. It invests in sports, media, food, technology and lifestyle startups with successful investments including &pizza, Momofuku and Resy (acquired by American Express).

Unlike traditional accelerators, RSE Ventures offers strategic investment, hands-on operational support and access to influential networks in sports and entertainment. Startups benefit from branding expertise, scaling guidance and growth capital.

For consumer-focused companies seeking to combine capital with cultural influence, RSE Ventures provides a unique edge in scaling brands to national and global audiences.

39. a16z Speedrun (Andreessen Horowitz)

Based in Silicon Valley, a16z Speedrun is a pre-seed program launched by Andreessen Horowitz, one of the most prestigious venture capital firms in the world. It focuses on helping founders validate ideas and quickly build scalable businesses in areas like AI, crypto and consumer tech.

The program lasts 12 weeks and provides $500,000 in funding via SAFE notes along with direct mentorship from a16z partners and access to its global network.

Founders benefit from tailored guidance on SaaS product development, go-to-market strategies and fundraising. Being associated with a16z offers unparalleled credibility and immediate investor visibility.

40. Obvious Ventures

Based in San Francisco, Obvious Ventures is a venture capital firm co-founded by Twitter’s Ev Williams focusing on world-positive startups in sustainability, health and people-focused innovation. Its portfolio includes companies like Beyond Meat, Diamond Foundry and Virta Health.

Obvious Ventures typically invests from seed to Series B with check sizes ranging from $2 million to $15 million. While not a traditional accelerator, it provides founders with deep expertise in scaling impact-driven businesses, connections to mission-aligned investors and strong brand recognition. For startups building solutions that balance profit with purpose, Obvious is an ideal backer.

41. Interplay

Interplay is a New York–based venture firm and startup studio that both invests in and incubates companies. Unlike traditional accelerators, Interplay co-founds and scales ventures from the ground up often embedding operational teams directly into early-stage startups. It offers access to its vast network of entrepreneurs, corporate partners and investors while providing critical infrastructure, resources and mentorship.

Startups benefit from a unique hybrid model that combines venture funding with hands-on company-building expertise making Interplay an ideal partner for ambitious founders looking for more than just capital.

42. Tenity

Formerly known as F10, Tenity is a global startup accelerator and early-stage investor with hubs in Zurich, Singapore, Madrid and Tallinn. It specializes in fintech, insurtech, regtech and deep tech. Tenity runs structured programs where startups get mentorship, co-working space and introductions to leading financial institutions and investors.

With backing from major banks and corporates, Tenity provides access to strong industry connections and growth opportunities. Startups gain not only seed funding but also a foothold in Europe and Asia’s thriving fintech ecosystems.

43. BioGenerator

Based in St. Louis, BioGenerator is a unique life sciences accelerator and investor that provides both capital and lab space to early-stage biotech and healthcare startups. It focuses on high-potential companies in therapeutics, diagnostics, medical devices and digital health.

Beyond funding, BioGenerator offers lab facilities, business expertise and access to a robust regional innovation ecosystem.

Startups benefit from mentorship by industry veterans and opportunities to collaborate with universities and research institutions. It’s particularly strong for founders seeking to advance scientific innovation into viable commercial products.

44. IndieBio

IndieBio part of SOSV is the world’s leading life sciences accelerator. Based in San Francisco and New York, it focuses on biotech, food innovation, healthcare and climate solutions. Startups receive $250,000 in funding, access to state-of-the-art lab space and intensive mentorship over a 4 month program.

IndieBio has launched companies tackling global challenges such as lab-grown meat, carbon capture and advanced therapeutics. Its alumni have raised billions in follow-on funding making it a premier launchpad for biotech innovators aiming to commercialize breakthrough science.

45. Health Wildcatters

Located in Dallas, Texas, Health Wildcatters is a healthcare-focused accelerator that invests in digital health, medical devices, diagnostics and healthcare services startups. Each year, it runs a 12 week program that provides seed funding of up to $350,000 along with mentorship from 200+ healthcare executives, clinicians and investors.

Startups gain access to an extensive network of healthcare partners and opportunities to validate their solutions in real-world settings. Health Wildcatters is a strong choice for health entrepreneurs who want to accelerate product-market fit and scale within the U.S. healthcare system.

46. MedTech Innovator

MedTech Innovator is the largest accelerator for medical device, diagnostic and digital health startups worldwide. Unlike traditional accelerators, it operates a global competition and accelerator program, selecting the most promising companies and providing mentorship, exposure and networking with industry leaders. It partners with top healthcare organizations like Johnson & Johnson, Baxter and Olympus.

Startups do not give up equity but still gain unmatched industry visibility, product development support and access to strategic investors. It’s an unparalleled platform for medtech founders to accelerate commercialization.

47. RGAx

RGAx is the innovation and investment arm of Reinsurance Group of America, one of the world’s largest life and health reinsurers. It focuses on insurtech and digital health startups that aim to transform the insurance industry. Startups benefit from funding, strategic partnerships and the opportunity to scale with RGA’s global network.

RGAx provides deep expertise in insurance innovation, actuarial science and consumer engagement making it a unique accelerator for companies developing disruptive solutions in underwriting, claims, health engagement and financial protection.

48. IQT (In-Q-Tel)

In-Q-Tel, often referred to as IQT, is the strategic investment firm that supports the CIA and U.S. national security community. It invests in cutting-edge technologies in AI, cybersecurity, biotech, robotics and more.

While not a traditional accelerator, IQT helps startups adapt their solutions for government and defense applications providing non-dilutive funding and long-term contracts.

Partnering with IQT gives startups credibility, access to government markets and the chance to commercialize dual-use technologies with significant societal impact. It’s best suited for deep tech innovators.

📈 Market Insights

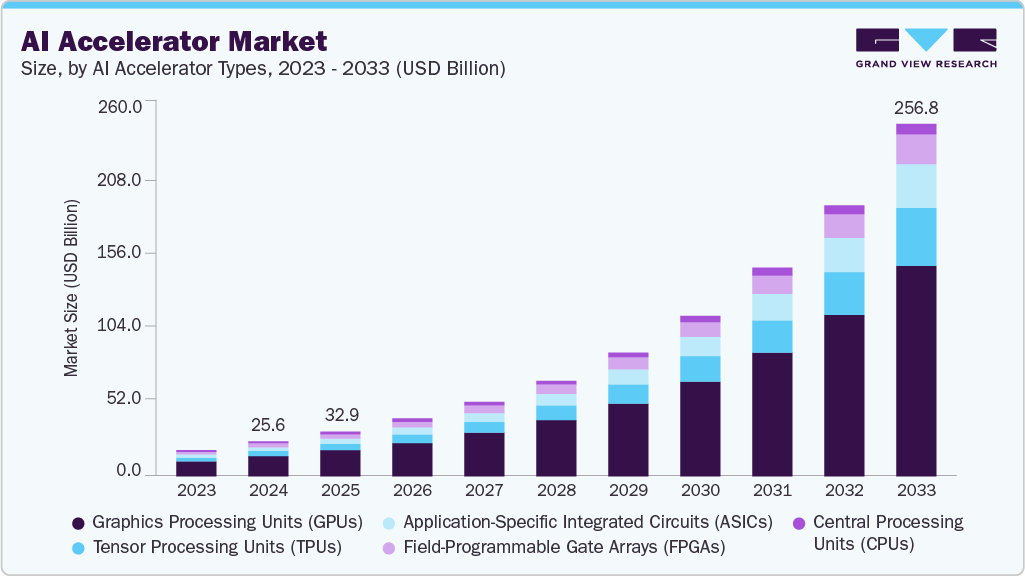

The Global AI Accelerator Market Size was estimated at USD 25.56 billion in 2024 and is projected to reach USD 256.84 billion by 2033, growing at a CAGR of 29.3% from 2025 to 2033.

49. Fledge

Fledge is a global impact accelerator supporting mission-driven startups tackling social, environmental and community challenges. Based in Seattle but with programs worldwide, it provides funding, mentorship and a 10 week curriculum designed to refine business models and prepare founders for scaling.

Fledge emphasizes “conscious companies” that prioritize profit with purpose. Its unique “repayable investment” model aligns investor and entrepreneur interests while fostering long-term sustainability. Startups benefit from a supportive ecosystem focused on impact making Fledge ideal for founders building purpose-driven ventures.

50. Elemental Excelerator

Elemental Excelerator, based in Honolulu and San Francisco focuses on climate-tech startups solving challenges in energy, mobility, water, circular economy and agriculture. It provides up to $1 million in funding along with hands-on support to deploy solutions in real-world settings. Elemental emphasizes community impact, helping startups demonstrate scalability while addressing systemic sustainability challenges.

With strong ties to corporates, governments and nonprofits, it helps climate startups achieve both financial and environmental outcomes. Its alumni include leaders in renewable energy and decarbonization.

51. Cleantech Open

Cleantech Open is the world’s largest clean technology accelerator, supporting early-stage climate and energy startups since 2005. It has helped over 1,500 companies that collectively raised more than $1.5 billion in investment. The program focuses on renewable energy, sustainable materials, water, agriculture and transportation.

Startups benefit from expert mentorship, investor connections and industry partnerships that accelerate commercialization. Its network spans corporates, governments and universities making it a strong choice for founders addressing climate change and environmental challenges.

52. AcceliCITY powered by Leading Cities

AcceliCITY run by Leading Cities is a global smart city startup accelerator based in Boston. It focuses on urban innovation, mobility, cleantech and civic technologies that make cities more resilient and sustainable. Since its launch, AcceliCITY has supported startups in over 70 countries.

Participants gain access to pilot opportunities with city governments, global corporate partners and urban development networks. The program emphasizes real-world deployment and market validation ensuring startups can scale solutions that improve city life, infrastructure and public services worldwide.

53. EIT InnoEnergy

EIT InnoEnergy, backed by the European Institute of Innovation and Technology, is one of the top accelerators for sustainable energy startups in Europe. It invests in and supports ventures across renewable energy, energy storage, smart grids and energy efficiency. Startups receive funding, business coaching and direct access to a network of more than 500 industry partners.

With over €560 million invested, it has backed more than 500 startups that raised billions in follow-on funding. InnoEnergy is central to Europe’s clean energy transition offering unmatched industry access.

54. Canopy Boulder

Canopy Boulder is a seed-stage accelerator and venture capital fund focused on cannabis technology, ancillary services and CBD startups. Based in Boulder, Colorado, it provides $30,000 to $120,000 in seed funding along with a 16-week program offering mentorship, investor connections and industry-specific resources.

Since 2015, it has helped over 130 companies raise more than $250 million. Its strong network in the cannabis and hemp industries makes it an ideal choice for entrepreneurs building tech, data analytics, compliance or supply chain solutions in the fast-growing cannabis sector.

55. CREATE-X (Georgia Tech)

CREATE-X is a startup accelerator from Georgia Institute of Technology, designed to help students launch successful companies. Since its founding, it has supported hundreds of student-led startups, providing mentorship, legal support and seed funding opportunities. The program emphasizes experiential learning, entrepreneurship education and customer discovery.

CREATE-X also connects participants with Georgia Tech’s deep research and alumni network. By combining academic expertise with real-world startup practice, it empowers students to transform innovative ideas into sustainable businesses before or right after graduation.

56. MIT Incubation Programs

MIT offers multiple incubation and accelerator programs including the Martin Trust Center for Entrepreneurship, MIT delta v and The Engine. These programs help founders commercialize groundbreaking research in areas such as biotech, AI, robotics and climate tech. MIT-backed startups have raised billions in venture funding and built transformative companies.

Founders gain access to MIT’s research ecosystem, labs and global alumni network along with mentorship from world-class experts. Its programs are highly selective but provide unmatched credibility and resources for deep tech entrepreneurs.

57. Alchemist Accelerator

Alchemist Accelerator, based in Silicon Valley, is a leading B2B-focused accelerator founded in 2012. It specializes in enterprise startups in sectors like AI, cybersecurity, IoT and blockchain. The program provides $25,000 in seed funding, mentorship and access to Fortune 500 customers and investors.

Alumni include Rigetti Computing and LaunchDarkly with portfolio companies raising over $6.2 billion collectively. Alchemist is known for its strong enterprise customer network, helping startups secure pilots and contracts early. It’s ideal for founders targeting the enterprise technology market.

58. HAX

HAX, operated by SOSV, is the world’s premier accelerator for hardware startups. Based in Shenzhen and Newark, it focuses on robotics, healthtech, industrial automation and IoT. Startups receive up to $250,000 in investment, prototyping resources and supply chain support. With direct access to China’s manufacturing ecosystem, HAX enables rapid product development and scaling.

Alumni include companies like Formlabs and Simbe Robotics. Its combination of funding, mentorship and world-class prototyping labs makes it the go-to accelerator for hardware founders building physical products.

59. Future Labs (NYU)

Future Labs, run by New York University, is a startup program focused on AI, cybersecurity, digital media and data-driven ventures. Based in New York City, it supports early-stage founders with mentorship, research access and pilot programs. Its applied AI and Urban Future Labs are particularly well-known with strong ties to corporates and government initiatives.

Alumni companies have raised hundreds of millions of dollars in venture capital. Founders benefit from NYU’s resources, a deep talent pool and opportunities to scale technology-driven businesses.

60. Outlier Ventures

Outlier Ventures founded in 2014 is a leading Web3 Development and blockchain-focused accelerator. Its Base Camp program supports startups in DeFi, NFTs, metaverse and decentralized infrastructure. It invests capital, provides mentorship and connects startups with its strong network of investors, developers and corporates.

Outlier has supported over 250 Web3 companies including Fetch.ai and Boson Protocol. The program also emphasizes token economics, governance and community building. For founders in blockchain and decentralized tech, Outlier Ventures offers specialized expertise and global growth opportunities.

61. Brinc

Brinc is a global venture accelerator founded in 2014, with a strong focus on hardware, IoT, robotics, food technology and sustainability-driven startups. It operates programs across Asia, the Middle East and beyond helping founders scale internationally.

Brinc provides investment (typically around $80K–$100K) along with tailored mentorship, supply chain expertise and access to corporate partners.

Startups benefit from Brinc’s specialization in deep-tech and impact-driven industries giving them a clear edge in markets where hardware and sustainability are key drivers.

62. EIT Digital Accelerator

EIT Digital Accelerator backed by the European Union focuses on supporting European deep-tech scaleups in areas like digital tech, industry, finance and health. Since its inception, it has accelerated more than 500 companies offering access to over 200 corporate partners and investors.

The program emphasizes international growth connecting startups with cross-border customers and funding opportunities. While it does not follow the traditional equity-for-funding model, it provides unmatched support in scaling businesses across the EU making it a strong choice for tech founders targeting European markets.

63. Lighthouse Labs RVA (Richmond, VA)

Lighthouse Labs RVA is Virginia’s startup accelerator, founded in 2012 and focuses on early-stage startups across industries. It offers $20,000 in equity-free funding, six weeks of intensive mentorship and access to a strong community of alumni and investors. Unlike many accelerators, it does not take equity making it attractive for founders seeking growth without dilution.

The program emphasizes founder well-being, community and regional development giving startups not just capital and advice but also a supportive ecosystem to launch and scale their businesses.

64. Slater Technology Fund (Rhode Island)

The Slater Technology Fund is a state-backed seed-stage investment fund in Rhode Island that has been operating since 1997. It focuses on tech-driven ventures in life sciences, software and energy. Rather than running a fixed accelerator program, Slater provides seed funding (often $50K to $250K) and ongoing mentorship.

It has invested in over 100 startups that went on to raise hundreds of millions in follow-on capital. Startups benefit from its deep local network, credibility and focus on developing Rhode Island’s innovation economy.

65. Maine Technology Institute (MTI)

The Maine Technology Institute (MTI) is a state-funded organization that supports innovation in Maine across seven sectors including biotech, IT consulting, precision manufacturing and clean energy. It provides grants, loans and equity investments to startups and early-stage companies.

Unlike accelerators, MTI operates year-round funding programs, often serving as the first institutional backer for Maine-based entrepreneurs. Since 1999, MTI has invested more than $280 million leveraging over $1 billion in follow-on private investment. Founders benefit from both capital and a strong local innovation ecosystem.

One of MTI’s latest Testimonials by Lia Morris, Senior Community Development Officer, Island Institute:-

66. JumpStart (Ohio)

JumpStart is a Cleveland-based nonprofit venture accelerator and investor that supports startups in Ohio and the Midwest. It offers seed funding, venture capital and intensive business support for tech-focused companies. Since 2004, JumpStart has helped over 1,000 entrepreneurs raise billions in follow-on funding.

Its programs range from accelerators for early-stage founders to growth-stage capital and corporate innovation partnerships. JumpStart is particularly valuable for startups outside Silicon Valley seeking strong regional backing, funding and mentorship while staying close to home markets.

67. South Carolina Research Authority (SCRA)

The South Carolina Research Authority (SCRA) is a state-chartered organization that provides funding and support to startups in life sciences, IT, advanced manufacturing and clean energy. Through its SC Launch program, SCRA offers non-dilutive grants, seed funding and access to investors.

Since 1983, it has supported hundreds of companies and helped attract billions in follow-on funding to South Carolina’s innovation economy. Founders benefit from SCRA’s credibility, funding opportunities and deep integration with research institutions and local industry partners.

68. Kairos (NY)

Kairos is a New York-based venture fund and startup builder founded in 2008, with a focus on solving global challenges in housing, healthcare and financial services. Rather than being a traditional accelerator, Kairos invests in and incubates companies tackling systemic problems through technology.

It has backed over 50 companies that collectively serve millions of customers worldwide. Founders benefit from Kairos’ mission-driven approach, access to capital and community of entrepreneurs solving meaningful problems with scalable solutions.

69. Fusion (Miami)

Fusion is a Miami-based accelerator program designed to support early-stage startups with mentorship, funding and community connections. It focuses on diverse founders and innovative business models across industries like fintech, health and digital commerce. Fusion offers seed funding (typically $50K to $150K) in exchange for equity alongside access to a network of investors and corporate partners.

Being based in Miami, Fusion also provides startups with access to Latin American markets making it ideal for founders targeting both U.S. and international growth.

70. Z80 Labs Technology Incubator (Buffalo, NY)

Z80 Labs is a technology incubator and seed fund based in Buffalo, New York, founded in 2012. It focuses on early-stage software, internet and mobile startups, offering workspace, mentorship and access to funding through the Buffalo Angel Network.

Z80 Labs provides small seed investments (usually $25K to $100K) and a strong local network to help startups scale. As part of Buffalo’s broader tech ecosystem, it plays a key role in fostering regional innovation and supporting entrepreneurs outside major U.S. hubs.

71. 25Madison (NYC)

25Madison is a venture studio and early-stage investor based in New York City that builds and funds companies from the ground up. With expertise in product, design and growth, they partner closely with founders to accelerate company-building.

Their network spans Fortune 500 companies, investors and seasoned operators giving startups direct access to strategic partnerships and funding.

25Madison also provides seed investment and shared resources like office space, engineering and design. For founders looking for hands-on support in building from concept to scale, this program offers a powerful launchpad.

72. AlleyCorp (NYC)

AlleyCorp is a pioneering venture fund and incubator founded by Kevin Ryan in New York City. Known for founding and funding companies like MongoDB, Business Insider, Zola and Gilt, AlleyCorp continues to create and invest in startups across healthcare, fintech, AI and more. It directly incubates ideas in-house while backing external founders with seed and Series A capital.

Startups benefit from close mentorship, NYC’s thriving ecosystem and an unparalleled network. AlleyCorp’s model makes it especially attractive for founders who want both financial backing and active involvement from one of NYC’s most successful entrepreneurial teams.

73. LAB Ventures (Miami)

LAB Ventures is a Miami-based venture builder and early-stage investor focused on proptech, fintech and sustainability. They specialize in co-founding startups helping with everything from ideation and validation to fundraising and scaling. LAB Ventures also runs the LAB Miami coworking space creating a collaborative environment for entrepreneurs.

Their strong connections in Latin America and the U.S. make them a great partner for founders targeting cross-border growth. With a mix of investment, mentorship and strategic corporate partnerships, LAB Ventures is an excellent choice for founders in real estate tech and beyond.

74. NMotion (Nebraska)

NMotion is a startup accelerator and venture studio based in Lincoln, Nebraska, supporting founders across the Midwest. Backed by gener8tor, it provides pre-seed investment, 12 weeks of programming and long-term mentorship. Startups benefit from access to corporate partners, investors and a growing entrepreneurial community in the Midwest.

NMotion focuses on scalable tech-enabled businesses and supports founders with workshops, resources and networking events. For entrepreneurs looking to build outside of traditional hubs like Silicon Valley or NYC, NMotion provides a supportive, close-knit ecosystem with strong funding connections.

75. RevUp by Betaspring (Providence, RI)

RevUp by Betaspring is a revenue-first accelerator based in Providence, Rhode Island. Unlike equity-driven accelerators, RevUp invests in growth by providing funding in exchange for a share of future revenue instead of equity. This makes it especially appealing for founders who want capital but prefer to keep ownership of their company.

The program focuses on sales, marketing and customer acquisition, offering hands-on mentorship and resources. RevUp is a strong option for early-stage companies ready to scale revenue without giving away equity.

76. The Brandery (Cincinnati, OH)

The Brandery is a nationally ranked accelerator in Cincinnati that emphasizes branding and marketing as key drivers of startup success. It provides $100,000 in funding, a 4-month program and access to Procter & Gamble’s world-class brand expertise, given Cincinnati’s corporate ecosystem. Founders gain mentorship, office space and exposure to investors across the Midwest.

With a strong focus on consumer-facing startups, The Brandery is ideal for entrepreneurs who want to sharpen their brand identity and customer acquisition strategies while tapping into Cincinnati’s corporate and investor networks.

77. Tech Wildcatters (Dallas, TX)

Tech Wildcatters is a Dallas-based accelerator that offers funding, mentorship and corporate partnerships. It runs a 12-week program with a focus on enterprise tech, fintech, healthcare and emerging technologies. Startups receive up to $130,000 in seed funding connections with Fortune 500 companies and access to Dallas’s fast-growing innovation ecosystem.

The program emphasizes founder development, sales growth and fundraising preparation. For entrepreneurs in Texas and the South, Tech Wildcatters offers an excellent entry point into a vibrant startup community with strong corporate backing.

78. Innovation Works (Pittsburgh, PA)

Innovation Works is one of the most active seed-stage investors in Pennsylvania, supporting tech startups in Pittsburgh and beyond. It provides pre-seed and seed funding, mentorship and connections to corporate partners and investors. Innovation Works also manages the AlphaLab accelerator and AlphaLab Gear for hardware startups.

With Pittsburgh’s reputation as a hub for robotics and AI, the program is especially attractive to founders in deep tech, hardware and life sciences. Its hands-on approach and funding support make it a leading choice for startups in the region.

79. Orange DAO

Founded by a community of over 1,300 Y Combinator alumni, Orange DAO is a unique venture collective that combines the power of a DAO (decentralized autonomous organization) with traditional venture capital. Since its inception in 2021, it has backed hundreds of early-stage startups across Web3, AI, fintech and other high-growth industries.

The DAO leverages its deep YC founder network to provide not just funding, but also peer-to-peer support, mentorship and global connections. Startups funded by Orange DAO gain access to one of the largest founder-driven communities in the world making it a standout choice for those building in fast-evolving tech sectors.

80. VentureOut (Global, NYC based)

VentureOut is a New York-based accelerator focused on helping international startups expand into the U.S. market. Its programs range from short-term market access bootcamps to longer-term accelerator tracks. Startups receive mentorship from industry experts, introductions to investors and connections to potential clients in the U.S.

VentureOut specializes in supporting growth-stage companies in fintech, healthtech, AI and SaaS. For international founders looking to establish a foothold in the U.S., VentureOut offers a structured and proven pathway to scale.

81. Internet Initiatives Development Fund (IIDF – Russia)

IIDF is Russia’s largest venture fund and accelerator focused on early-stage tech startups. Since 2013, it has supported more than 400 companies with funding, mentorship and access to the Russian and CIS markets. Its accelerator program emphasizes product-market fit, customer acquisition and scaling strategies in emerging markets.

With access to a strong investor and corporate network, IIDF is a leading choice for founders targeting Eastern Europe and Russia.

82. AGORANOV (France)

Based in Paris, Agoranov is one of France’s top public incubators and has supported over 450 startups since 2000 including Doctolib and Criteo. Its focus spans deep tech, life sciences and digital transformation.

Startups benefit from office space, tailored mentorship, public grants and direct connections to France’s academic and research institutions. Agoranov’s reputation in Europe makes it a trusted launchpad for research-driven ventures.

83. Ontario Centres of Excellence (Canada)

OCE, now part of Ontario Centre of Innovation (OCI), helps startups, researchers and corporations collaborate to drive innovation across industries like AI, healthtech and cleantech. It provides non-dilutive funding, mentorship and industry partnerships.

With strong ties to universities, corporations and government programs, OCE is ideal for Canadian founders aiming to validate technologies and bring them to market with minimal equity dilution.

84. EIC Accelerator (EU)

Part of the European Innovation Council, EIC Accelerator is one of the most prestigious EU funding programs for deep-tech and breakthrough innovations. It provides up to €2.5 million in grants and up to €15 million in equity financing.

Startups gain access to world-class coaching, corporate partnerships and the European Commission’s vast network. It’s especially attractive for scale-ups addressing global challenges in sustainability, health and digital innovation.

85. Bienville Capital (Global)

Bienville Capital is a New York-based investment firm supporting ventures in fintech, biotech and emerging technologies. Its focus is on long-term value creation with strategic investments and advisory.

While not a traditional accelerator, Bienville provides capital and market expertise to innovative startups. Founders benefit from close collaboration, operational insights and access to global institutional investors.

86. ArtsFund (Seattle based)

ArtsFund is a Seattle-based nonprofit supporting creative, cultural and impact-driven organizations. It provides funding, mentorship and advocacy for arts-focused ventures. While not a tech accelerator, ArtsFund empowers startups at the intersection of creativity, community and impact.

Founders committed to cultural innovation and social good benefit from its network of philanthropists and civic leaders.

💡 Vital Insights

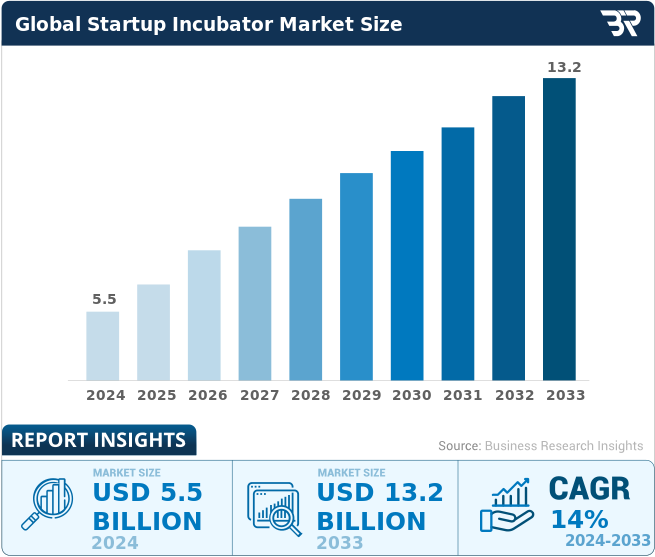

The startup incubator market size was valued at approximately USD 5.50 billion in 2024 and is expected to reach USD 13.20 billion by 2033, growing at a compound annual growth rate CAGR of about 14% from 2025 to 2033.

87. DMZ (Canada – Toronto)

DMZ at Toronto Metropolitan University is one of the world’s top university-based startup incubators. Since 2010, it has helped over 800 startups that raised more than $2.5 billion.

Its programs offer equity-free support, mentorship, workspace and global investor access. DMZ specializes in tech startups across fintech, AI and healthtech making it a powerful launchpad for Canadian and international entrepreneurs.

88. Springcamp (South Korea)

Springcamp is an early-stage accelerator based in Seoul backed by Naver Corporation. It supports startups in mobile, internet and consumer-focused tech. With strong connections to Korea’s tech ecosystem including Naver and Line, founders benefit from strategic partnerships, funding and global expansion opportunities in Asia. Its focus on rapid product development and scale makes it ideal for ambitious founders.

89. CNTTECH (South Korea)

CNTTech is a South Korean accelerator and investor specializing in foodtech and restaurant-tech startups. It offers seed investment, access to its own restaurant franchise network and strong connections to Korea’s food service industry.

Startups benefit from real-world pilot opportunities, mentorship and funding to expand across Asia’s growing food and retail sectors.

90. BonAngels Venture Partners

BonAngels is one of South Korea’s most respected early-stage VC firms, known for backing successful startups like Woowa Brothers (Baedal Minjok). It provides seed and Series A funding along with hands-on mentorship and strategic guidance.

With strong ties to Korea’s startup ecosystem and connections to global investors, BonAngels is an ideal partner for founders seeking to scale innovative products in Asia and beyond.

91. CyberAgent Capital

CyberAgent Capital is one of Japan’s leading venture capital firms with a strong focus on internet, mobile and media startups across Asia. With offices in Tokyo, Beijing, Seoul and Jakarta.

It provides funding and strategic support to help startups scale internationally. Founders benefit from CyberAgent’s media ecosystem, corporate partnerships and access to one of the largest digital advertising networks in Asia.

92. SVG Ventures

SVG Ventures is a global investment and innovation platform known for its THRIVE Accelerator program, the world’s leading agri-food tech accelerator. It partners with corporations like Bayer, Corteva and Trimble to support startups driving innovation in agriculture, food production and sustainability. Founders gain access to funding, corporate pilot programs, global exposure and Silicon Valley investor networks.

93. MetaProp

Based in New York, MetaProp is the world’s leading PropTech-focused accelerator and VC firm. It has backed over 150 startups in areas like real estate SaaS, construction tech, IoT and smart cities.

Its accelerator program provides seed funding, mentorship, pilot opportunities with real estate giants and exposure to global investors. For PropTech startups, MetaProp is one of the most influential networks worldwide.

94. LAB Ventures

LAB Ventures is a Miami-based venture builder and early-stage investor specializing in real estate and construction tech. It connects startups with major developers, property managers and investors in the U.S. and Latin America.

Its LAB Miami coworking hub provides a collaborative ecosystem for entrepreneurs. Founders in PropTech benefit from mentorship, pilot programs and regional market access.

95. Dreamit Ventures

Dreamit Ventures is a U.S.-based accelerator and venture fund that runs vertical-specific programs in real estate (Dreamit UrbanTech), healthtech and securetech. It offers startups access to Fortune 500 customers, pilot opportunities and enterprise partnerships.

Dreamit’s focus is on later-stage startups with market-ready products helping them accelerate sales, scale operations and secure follow-on funding.

96. Cannabis Tech

Cannabis Tech covers various aspects of the cannabis industry, with a focus on cultivation technology, business and finance and cannabis device reviews, emphasizing the importance of sustainability and reducing pesticide use.

Articles discuss energy management best practices for cannabis cultivation, the necessity of pesticides and methods for improving pathogen control.

97. FuturePlay

FuturePlay is one of South Korea’s most prominent early-stage venture builders and investors with a strong focus on deep tech startups in AI, robotics, biotech and advanced engineering. They provide funding, mentorship and hands-on support in building scalable companies from idea stage to global expansion.

FuturePlay is known for its unique “techpreneur-in-residence” model where entrepreneurs get access to labs, R&D expertise and strategic corporate partners in Korea and Asia.

98. Obvious Ventures

Obvious Ventures is a San Francisco-based venture capital firm co-founded by Twitter’s Evan Williams. It invests in startups driving systemic change in sustainability, healthcare, fintech and purpose-driven industries.

With its philosophy of “world positive investing,” Obvious provides not just capital but also mission-aligned support to entrepreneurs reshaping the future. It’s an excellent fit for impact-focused startups.

99. Paul G. Allen Family Foundation

The Paul G. Allen Family Foundation supports bold, high-impact initiatives in climate, biodiversity, arts and technology for good. While not a traditional accelerator, it funds nonprofit and for-profit ventures tackling global challenges.

Founders benefit from grant funding, philanthropic partnerships and alignment with a mission-driven organization that champions transformative innovation.

100. EvoNexus

EvoNexus is a non-profit startup incubator based in San Diego, Irvine and Silicon Valley. It is supported by corporate partners like Qualcomm, Viasat and Verizon making it an excellent hub for startups in wireless, 5G, fintech, MedTech and deep tech.

Unlike many accelerators, EvoNexus does not take equity upfront, providing founders with office space, mentorship and access to pilot programs with Fortune 500 companies. This makes it one of the most founder-friendly incubators in the U.S.

Comparison Table: The 100 Best Startup Accelerators & Incubators

This table highlights 100 leading startup accelerators and incubators worldwide, showcasing their industry focus, unique value propositions and official websites. It serves as a quick reference for founders seeking the right launchpad for growth.

|

Sr No. |

Company | USPs | No. of Investments |

Institution Type |

| 1 | Y Combinator | World’s leading accelerator; backed 4,000+ startups including Airbnb, Stripe and Dropbox. | 4366 | Startup Accelerator |

| 2 | Techstars | Global accelerator network with 50+ programs worldwide; strong corporate partnerships. | 3570 | Startup Accelerator |

| 3 | 500 Startups | Focus on growth marketing and fundraising; invested in 2,800+ startups globally. | 2770 | Startup Accelerator |

| 4 | MassChallenge | Zero-equity accelerator supporting early-stage startups across industries. | 3050 | Startup Accelerator |

| 5 | AngelPad | Selective accelerator ranked #1 in U.S. by MIT Seed Accelerator rankings; strong founder mentorship. | 180 | Startup Accelerator |

| 6 | StartX (Stanford) | Stanford-affiliated, nonprofit accelerator; supports Stanford founders without taking equity. | 332 | Startup Incubator & Accelerator |

| 7 | LAUNCH | Founded by Jason Calacanis; offers accelerator, angel investing and startup conference. | 382 | Founder University & Accelerator |

| 8 | Boomtown Accelerators | Specializes in health, wellness and technology startups; offers customized mentorship. | 174 | Startup Accelerator |

| 9 | Gener8tor | One of the top 15 accelerators in U.S.; runs accelerator, pre-accelerator and corporate programs. | 200+ | Startup Accelerator |

| 10 | Forum Ventures | B2B SaaS-focused accelerator and fund; provides pre-seed capital, mentorship and customer access. | 312 | Startup Accelerator |

| 11 | Newchip Accelerator | Online, equity-free accelerator; provides global access to resources and mentorship. | 2000+ | Startup Accelerator |

| 12 | Village Capital | Peer-selected investment model; focuses on social impact and sustainability startups. | 302 | Startup Accelerator |

| 13 | Founders Factory | Corporate-backed accelerator and venture studio; provides hands-on operational support. | 200+ | Startup Accelerator |

| 14 | TechNexus Venture Collaborative | Focuses on corporate innovation partnerships; connects startups with large enterprises. | 153 | Startup Incubator & Accelerator |

| 15 | Coplex | Venture builder partnering with industry experts to launch tech startups. | 300+ | Startup Accelerator |

| 16 | Entrepreneurs Roundtable Accelerator (ERA) | NYC’s leading accelerator; 4-month program with strong mentor and investor network. | 230+ | Startup Accelerator |

| 17 | Capital Factory | Texas’ most active startup hub; provides co-working, mentorship and VC connections. | 177 | Startup Incubator & Accelerator |