Quick Summary :- Are you planning to launch your own startup in the financial app development business sector? The evolution of fintech has brought in a lot of transformation in the banking and financial sector. Here are 15 finance app ideas that can help you start your own business venture starting from developing digital banking apps to eWallets, blockchain apps, and many more.

Technology continues to transform the world by providing faster, more intelligent solutions to daily problems. In the once two decades, the fiscal world has experienced an inconceivable metamorphosis driven by digital technology. With the arrival of smartphone apps, banking, insurance, and investments are now more accessible than ever — available anytime, anywhere with a many clicks.

Whereas fintech enjoyed a significant rush of venture capital in the early 2020s, the industry has recalibrated slightly. For PitchBook, global fintech backing totalled $54.2 billion in 2024, back to pre-pandemic situations, last reported in 2019. With this shift away, the space remains vibrant and full of opportunity, with new startups bringing out innovative results within spaces similar to digital banking, blockchain, and investment platforms.

Successful Fintech Startup Ideas in 2025

Here are some innovative fintech app development ideas that can be converted into profitable businesses.

Digital banking

In just six years, a paradigm shift has been observed in the use of digital banking methods. Today, almost 69% of customers use online banking and mobile banking applications to carry out day-to-day tasks smoothly and independently.

These include viewing account balance, downloading e-statements, adding beneficiaries and executing IMPS and third-party transactions.

Bank customers can ditch long queues at the banks and ATMs as most of the payments activities can be managed via netbanking and mobile banking apps.

The popularity of these apps is driven by digitization policies of the governments, unreliable times like the COVID-19 outbreak, robust security measures implemented by banks, and much more. Thus, building a digital banking app is a wonderful finance startup idea.

Relevant example: HSBC Mobile Banking App.

eWallets

One of the most on-demand applications in modern times, eWallets have increased the convenience of people to pay bills, pay at physical merchant stores, across various e-commerce stores and other online mediums with absolute ease.

In the East, AliPay has significant market domination whereas, in the West, Apple Pay has occupied a major portion of the market share. PayPal (online money transfers platform), launched in 1999, is among the world’s first few eWallets. Thus, developing an eWallet is another brilliant finance app idea in modern times.

Relevant example: Apple Pay.

P2P payment apps

Peer-to-peer payments solutions is another growing area in the fintech app development sector. These apps are eliminating the need to rely on third-party websites to facilitate easy fund transfers between accounts.

This is a promising area of development and entrepreneurs can certainly focus here to launch their fintech startups. Developers are experimenting with innovative technologies to make P2P payments more efficient and secure with biometrics incorporation, facial recognition tech, and a lot more.

Relevant example: Venmo.

Crowdfunding apps

Crowdfunding refers to the accumulation of small amounts of capital from multiple individuals to start a new business venture. The role of these platforms is to bring investors and entrepreneurs together to increase the pool of investors other than usual sources.

Thus, designing crowdfunding apps and websites holds a lot of potential as there will be no dearth of customers ever.

Relevant example: GoFundMe.

PFM apps

PFM is the abbreviated form of a personal finance management app. With the expansion in the investment options along with expenditures of various forms, people often struggle to keep track of everything.

Thus, PFM apps come into the picture to help people keep track of their earnings, expenditures, savings, and investments easily in one place. Hence developing PFM apps is another cool finance app idea in 2025.

Relevant example: Robinhood.

Blockchain apps

Wondering which fintech startup idea can be the best one to launch your entrepreneurial venture into the market? Here is a smart fintech app development concept for you which is truly having a futuristic scope.

As it is known that digital currencies are ready to sweep the markets in the near future, leveraging blockchain technology to build apps that facilitate cryptocurrency transactions is a hot opportunity in 2025.

Relevant example: Mycelium blockchain wallet.

Loan lending apps

Here is another excellent idea to kickstart your fintech business venture. Developing loan lending apps can solve the problem of loan seekers and lenders by connecting them on a common platform.

Relevant example: MoneyTap.

Investment apps

With the rise in investment options, users can create a diverse trading portfolio but at the same time, it becomes increasingly complex to manage all investments easily. Therefore, developing trading apps can solve this problem for investors and help them manage stocks, equity funds, shares, crypto assets all at once.

Thus, businesses can make scalable, secure applications that can help people manage funds, compare data from different sources, and speculate prices of trading assets easily.

Relevant example: SoFi.

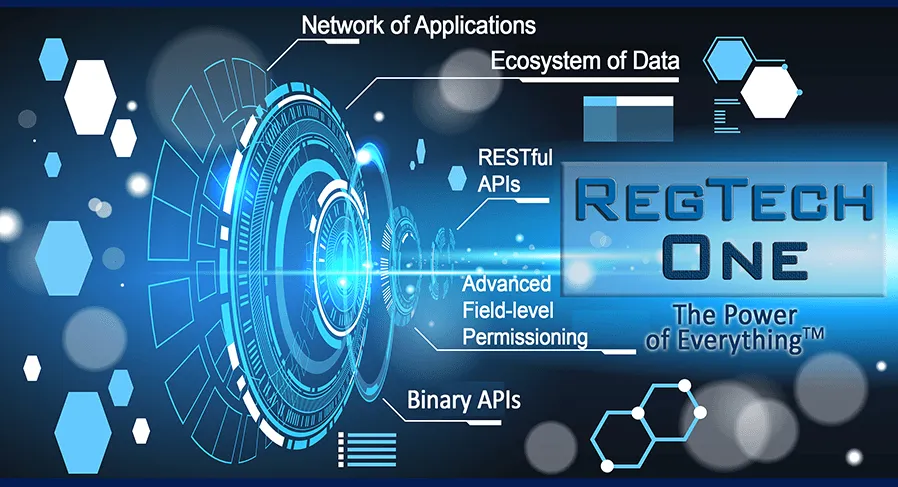

RegTech apps

This is another upcoming area in the fintech sector which is basically a regulatory application dealing with regulatory challenges in the area of finance and economy.

Thus, RegTech mobile apps can connect clients and legal entities, keep the customers updated on new financial regulations and government policies, keep track of payment transactions, and a lot more.

Relevant example: Trunomi.

Insurtech apps

The area of insurance is not left behind when it comes to modernization and development. Thus, insurance fintech applications are developed with the integration of various innovative technologies like IoT services, data science, business intelligence, and AI.

These mobile apps can cater to customers round-the-clock, take care of their premium payment needs, manage all their policies, and keep them updated on the latest insurance programs. Hence this is another finance business idea for entrepreneurs.

Relevant example: Kakau.

Robo advising programs

Driven by machine learning, these programs can provide customized investment advice to investors at seemingly less charges. They are enabled with automatic price prediction ability of trading assets and are capable of analyzing expenditures.

Cryptocurrency Exchanges

Crypto trading platforms are on the rise in the last couple of years as cryptocurrency trading is gaining worldwide prominence. In March 2021, there were reportedly 9,000 altcoins in the market other than Bitcoin. The cryptocurrency market cap is equal to 2 trillion USD.

Cryptocurrency trading exchanges bring buyers and sellers together facilitating fiat as well as crypto asset trading. Thus, designing these exchanges with the help of blockchain technology can be challenging yet profitable.

Relevant example: Binance.

Financial record maintenance apps

Maintaining payment receipts, tax invoices, and several financial records can be a difficult task for some people. Therefore, to make financial record maintenance a hassle-free task for busy people, designing these apps can definitely serve as a great financial business idea.

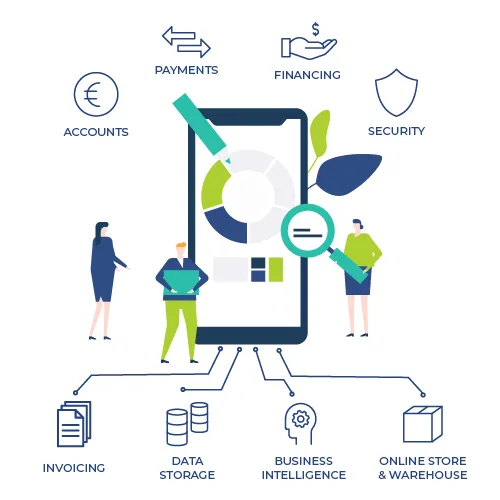

One-stop banking solutions apps

Making a multi-purpose app for managing all banking and investment needs like facilitating quick transactions, checking balance, investing in different trading assets, and doing a lot more is what one-stop banking solution apps are for.

E-Mortgage apps

This is quite a new fintech app idea that emerged recently ever since the COVID-19 pandemic took its toll on the world from 2020 onwards. Getting a mortgage became harder for people since last year, so now electronic mortgage apps have made the mortgage application process simple so that people can get contactless mortgages quickly.

Trending FinTech Technologies in 2025

The following are the supporting pillars of fintech applications that are driving it forward:

- AI – It can help in identifying scrupulous activities and offer customized financial advice.

- IoT – Leveraging the power of interconnected devices to the Internet, this innovative solution can help in gathering real-time data and assist with improved decision making.

- Blockchain – Blockchain can enable fast and secure transactions.

- Big Data – This can help in analyzing market trends, interpreting customer behaviour and large volumes of data.

- Cybersecurity – Security is indispensable for fintech apps. Thus, Source Code Analytics, DevSecOps, and many other advanced technologies play a key role in securing people’s money and data.

Also Read: Top Internet-of-Things (IoT) Applications & Examples

Some Quick Facts & Stats About Fintech Apps

- The global mobile payment market size was valued at USD 40.59 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 35.3% from 2022 to 2030

- If you look at the country-wise adoption rate of fintech apps, then China tops the list with an 81.1% adoption rate.

- Binance, the world’s leading cryptocurrency exchange, has managed to generate a revenue of $1,200 million annually among all online trading apps.

- AliPay is the most widely used mobile payments app globally with 650 million users worldwide.

Conclusion

The fintech revolution has only just begun, and the possibilities for startups are huge and varied. Whether digital banking, blockchain apps, or robo-counsels, every conception has the potential to revise the way people deal with wealth. Through the use of new technologies and addressing real-life financial challenges, startups can produce lasting change in 2025 and further. So if you are ready to innovate, these finance app generalities are your stepping stone to success.

-

What is India contributing to global fintech markets?

India’s fintech industry is one of the fastest-growing in the world and is worth $50 billion in 2021, with over 6,600 fintech startups. It’s a country which boasts a high fintech adoption rate of 87% and is successful in drawing in great sums of investments.

-

What factors are accelerating the growth of the fintech market?

Key factors include rising penetration of digital payment solutions, growth in mobile banking, progress in blockchain and AI (Artificial Intelligence) technologies, and a focus on financial inclusion.

-

What would the future of FintechStartups be like?

Emerging technologies such as AI, machine learning, blockchain and digital currency will continue to be integrated into fintech startups’ offerings. They will also prioritise creating frictionless customer experiences and increasing financial inclusion.

-

What are the fintech companies' investment trends?

Fintech investments slackened in 2022, but the sector still dwarfs many others in terms of dollars invested, with billions going into digital payments, blockchain, and AI-powered finance.

-

What is the key to success for fintech startups in a crowded market?

How can Fintech startups become successful? By providing innovative solutions, a user-friendly design, security and regulatory adherence and by using cutting-edge technologies that set them apart from the competition.